Learn the different ways of how Kruncher can automate your deal screening and their customization options.

GUIDE INDEX

- Defining Your Investment Criteria

- Automated Deal Screening: Match & No Match Labels

- Automated Watchlist and Portfolio Monitoring

- Email Templates for Founder Outreach

Defining Your Investment Criteria

Get Kruncher to think like your fund by assigning it your fund's investment criteria by choosing focus areas and dealbreakers across 5 dimensions: Business Model, Stage, Geography, Industry, and Revenue Profile.

This investment criteria can be changed anytime, so as you refine your investment strategy, you can easily update your criteria and Kruncher will apply it automatically to new deals.

Click here to customize your investment criteria.

Then, click "Create new version". This will open a full-screen pop-up to start the configuration process.

Click "Set Up Criteria" to start selecting your preferences for Business Model, Stage, Geography, Industry, and Revenue Profile.

Next, you’ll define how important each option is by marking it as a Focus, Neutral, or Deal Breaker.

Here is how Kruncher defines Focus, Neutral, and Dealbreakers:

Focus – Signals a strong preference. Companies that match your Focus areas will be marked as a Match.

Neutral – You’re open to these, but they’re not a strong signal either way. Companies with these traits will still be shown.

Dealbreaker – Hard exclusions. Companies with these characteristics will be flagged as No Match, helping you avoid deals that don’t fit your thesis.

Once you complete these steps, your new investment criteria will be created and selected automatically.

NOTE: New investment criteria will only apply to future analyses. Existing company reports under a previous criteria will remain unchanged.

Read this guide to learn more about customizing your investment criteria.

Automated Deal Screening: Match & No Match Labels

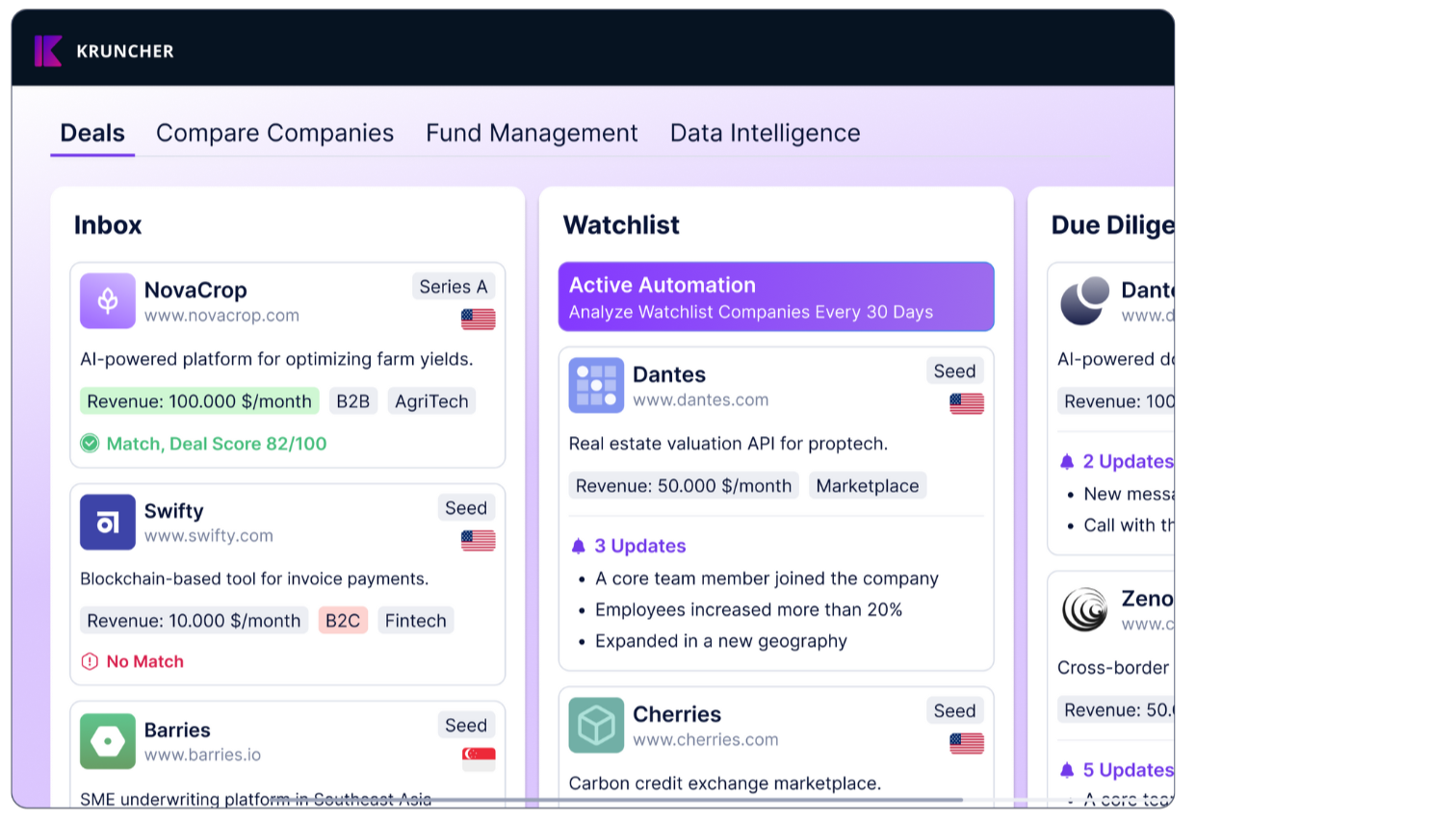

Crucial for users with a high-volume of deal flow, Kruncher automates the entire deal screening process by assigning Match or No Match labels to every inbound deal.

These assignments are based on your configured investment criteria, so you can ensure that Kruncher screens deals with the same logic as you.

Automated Watchlist and Portfolio Monitoring

After an initial Match, the company often goes to your watchlist for some time before you make a decision.

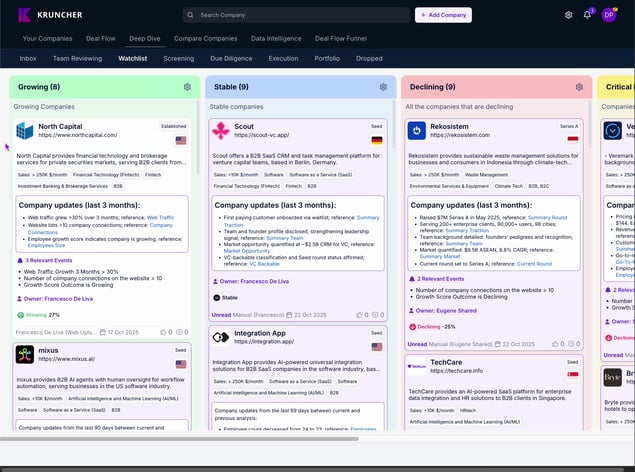

Kruncher also automates both your watchlist and portfolio monitoring with over 300 recognized metrics and signals that it tracks.

An additional layer of intelligence also works out what is important, ensuring that you only get key updates and not minor, noisy notifications.

Monitoring then becomes systematic, tailored to each company, and ready for partners, boards, and LPs, without manual spreadsheet work.

For example, this is how Watchlist monitoring may look like:

To do this, you need to toggle on automations for your Watchlist or Portfolio.

This will automatically re-run ALL company analysis in your Watchlist/Portfolio every 1/2/3 months, giving you growth and decline signals and a numerical growth score.

Growth Score is a percentage number (%), both positive and negative. The higher the number, the better and faster growth rate that company is showing. Negative numbers means the company is de-growing, or in other words, declining.

Email Templates for Founder Outreach

As a natural extension to connecting your email inbound into Kruncher, you can also send reply emails from within Kruncher, with content automatically populated referencing unique details about the company.

This process automates and massively simplifies your outreach process, reducing it to a few clicks compared to manually researching the company and the founders' Linkedin, etc.

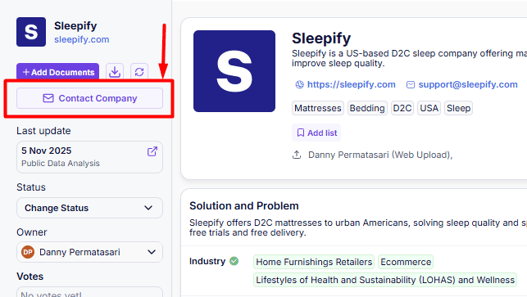

Inside company reports, click the "Contact Company" button on the left bar just below the company's logo.

This will open a floating window and it will ask for you to choose an email template to use.

NOTE: Read more on customizing email templates in this guide.

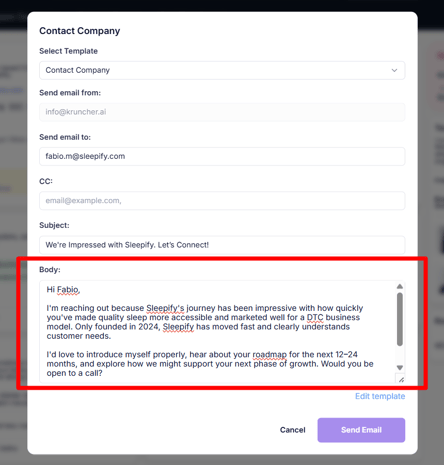

After you selected a template, you can view what will be sent to the company/founder.

The template follows the overall structure set in the email template customization, but each email content is customized precisely to the company's most recent situation with your fund details as well.

After everything is filled up to your satisfaction, press the "Send Email" button.

Your email will be sent from your client as if you had typed it natively in Gmail/Outlook/etc.

Note that this button will appear as "Open Email" if you have not connected your email to Kruncher.

Read this guide to learn more about automating your outreach.