Everything in Kruncher is configurable. You set up how Kruncher thinks and makes judgments and define what's positive and important; we don't assume anything about how your fund works.

Each Kruncher workspace is custom, but also adaptive and automatic to each fund’s thesis. Once customized, the platform reflects the fund’s thesis while removing the configuration burden for large, diverse portfolios.

GUIDE INDEX

- Customizing Kruncher for Your Workflow

- Connecting Your Email

- Setting Up Automated Deal Screening (Match vs No Match)

- Integrations Overview

- Customizing Investment Memos, Portfolio Reports, and Preparation Notes

- Complete List of Signals

- Customizing Signal Tracking

- Creating Custom Templates (IC Decks, LP Reports, Investment Memos)

Customizing Kruncher for Your Workflow

One of Kruncher's core design philosophies is that Kruncher augments existing workflows rather than replaces them.

This can look like:

- Set up Kruncher to think exactly like your fund by aligning investment criteria and judgement frameworks.

- You can use Kruncher via the apps you already use everyday: Email, Whatsapp, Slack, Telegram, and more.

- Push structured data back into CRMs, data warehouses, and internal dashboards.

This makes Kruncher extremely flexible to what your fund needs. Some funds use Kruncher as their main CRM to keep track of deals. Other funds may use Kruncher as a powerful backend engine and their CRM remains the UI.

If you would like Kruncher for your fund's unique workflow that hasn't been mentioned by us yet, schedule a call with our team.

Connecting Your Email

We have designed an email integration system that enables you to:

- Automatically process inbounds: When emails arrive at the connected email address, Kruncher automatically use them to update reports. The system continuously tracks progress and keeps reports current.

- Automate your outreach: Automate sending personalized outreach emails to companies/founders. Each generated outreach message is unique with details about their company and your fund, all configurable and customizable.

These use cases are designed to reduce manual work in your processes, and keeping your information about companies up-to-date without the mental load of remembering and following-up.

To do this, go to (1) Settings (⚙️) on the top right, and choose the (2) Connect Email tab at the left. Then, (3) choose your email client: Gmail or Outlook.

You will be re-directed to sign-in and grant access and permissions to Kruncher to send and receive email.

NOTE: Kruncher is GDPR Compliant, ISO 27001 Certified and SOC 2 Type 1 Certified. Kruncher does not store your data. Read more about our data & privacy policy here.

You can also terminate the email connection anytime by clicking the red "Disconnect" button underneath Action.

Read this guide to learn more about connecting your email.

Setting Up Automated Deal Screening (Match vs No Match)

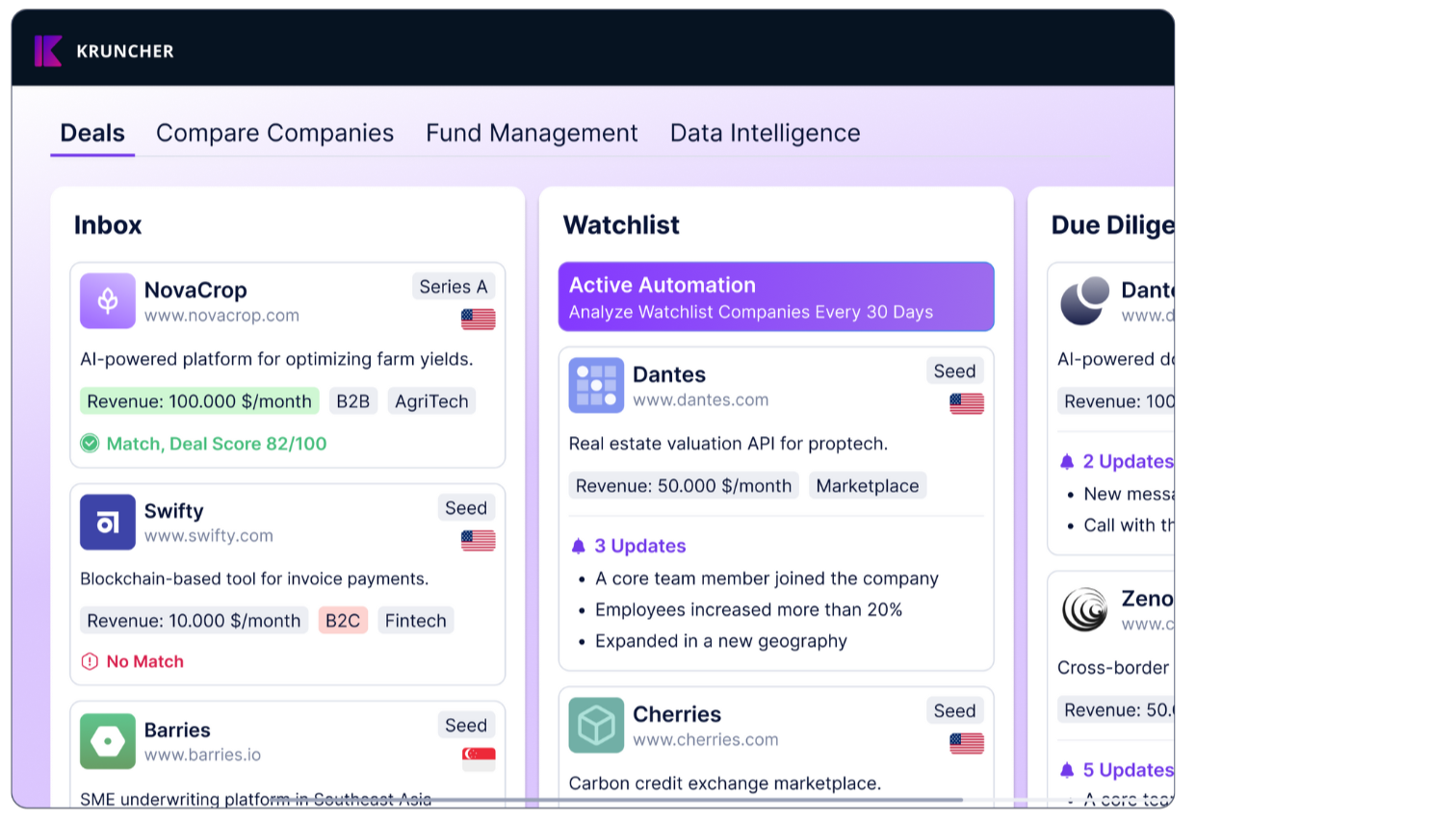

Crucial for users with a high-volume of deal flow, Kruncher automates the entire deal screening process by assigning Match or No Match labels to every inbound deal.

These assignments are based on your configured investment criteria, so you can ensure that Kruncher screens deals with the same logic as you.

Click here to customize your investment criteria.

Then, click "Create new version". This will open a full-screen pop-up to start the configuration process.

Click "Set Up Criteria" to start selecting your preferences for Business Model, Stage, Geography, Industry, and Revenue Profile.

Next, you’ll define how important each option is by marking it as a Focus, Neutral, or Deal Breaker.

Here is how Kruncher defines Focus, Neutral, and Dealbreakers:

Focus – Signals a strong preference. Companies that match your Focus areas will be marked as a Match.

Neutral – You’re open to these, but they’re not a strong signal either way. Companies with these traits will still be shown.

Dealbreaker – Hard exclusions. Companies with these characteristics will be flagged as No Match, helping you avoid deals that don’t fit your thesis.

Once you complete these steps, your new investment criteria will be created and selected automatically.

NOTE: New investment criteria will only apply to future analyses. Existing company reports under a previous criteria will remain unchanged.

Read this guide to learn more about customizing your investment criteria.

Integrations Overview

One of Kruncher's core design philosophies is that Kruncher augments existing workflows rather than replaces them.

Everything in Kruncher is configurable. You set up how Kruncher thinks and makes judgments and define what's positive and important; we don't assume anything about how your fund works.

This can look like:

- Set up Kruncher to think exactly like your fund by aligning investment criteria and judgement frameworks.

- You can use Kruncher via the apps you already use everyday: Email, Whatsapp, Slack, Telegram, and more.

- Push structured data back into CRMs, data warehouses, and internal dashboards.

If you have an account, see all available integrations in your settings page.

This makes Kruncher extremely flexible to what your fund needs. Some funds use Kruncher as their main CRM to keep track of deals. Other funds may use Kruncher as a powerful backend engine and their CRM remains the UI.

If you would like Kruncher for your fund's unique workflow that hasn't been mentioned by us yet, schedule a call with our team.

Customizing Investment Memos, Portfolio Reports, and Preparation Notes

Every generated company report in Kruncher comes with either an Investment Memo, Portfolio Performance Report, or Preparation Notes pertaining the company.

- Investment Memo: A recommendation/justification of why your fund could invest in this company.

- Portfolio Performance Report: A periodical report of a portfolio company: how it's doing, growth so far, highlights, concern areas, and lists action items if any.

- Preparation Notes: By default, this note is used to assist your first meeting with the company's founders, providing topics to touch on and additional context for you.

Example of a generated Investment Memo:

These memos are auto-generated by a prompt that lays down how they are generated.

Find the prompt editors here or by clicking on the "Customize AI Prompt" button at the bottom right of a memo.

These prompts work like a message you send to LLMs like ChatGPT/Claude/Gemini to perform a specific task, provide context, and lay down output structures.

Simply edit the text directly per your own fund's needs.

When done, click on the "Save Changes" button.

By default, the Inbox deal stage generates Preparation Notes. The Portfolio deal stage generates Portfolio Performance Reports. Every other deal stage generates Investment Memos.

To change this which memo each deal stage will generate, click on the (⚙️) icon on each column of the deal stage, and select the appropriate memo on "Memo Type".

Click Save.

Read this guide to learn more about customizing memos.

Complete List of Signals

Kruncher automates your monitoring with over 300 recognized metrics and signals that it tracks.

An additional layer of intelligence also works out what is important, ensuring that you only get key updates and not minor, noisy notifications.

Monitoring then becomes systematic, tailored to each company, and ready for partners, boards, and LPs, without manual spreadsheet work.

This is what that monitoring and signals may look like in practice:

Customizing Signal Tracking

Make Kruncher work exactly like your fund by aligning your definition of positive and negative signals. Customize the signals that Kruncher tracks and assign them sentiment values.

To start, go to Settings (⚙️) -> Track Company Events on the left tab, or click here.

Kruncher has already have some set up by default. You can add, edit, and remove tracked signals/events to fine-tune this system.

Read this guide to learn more about customizing signal tracking.

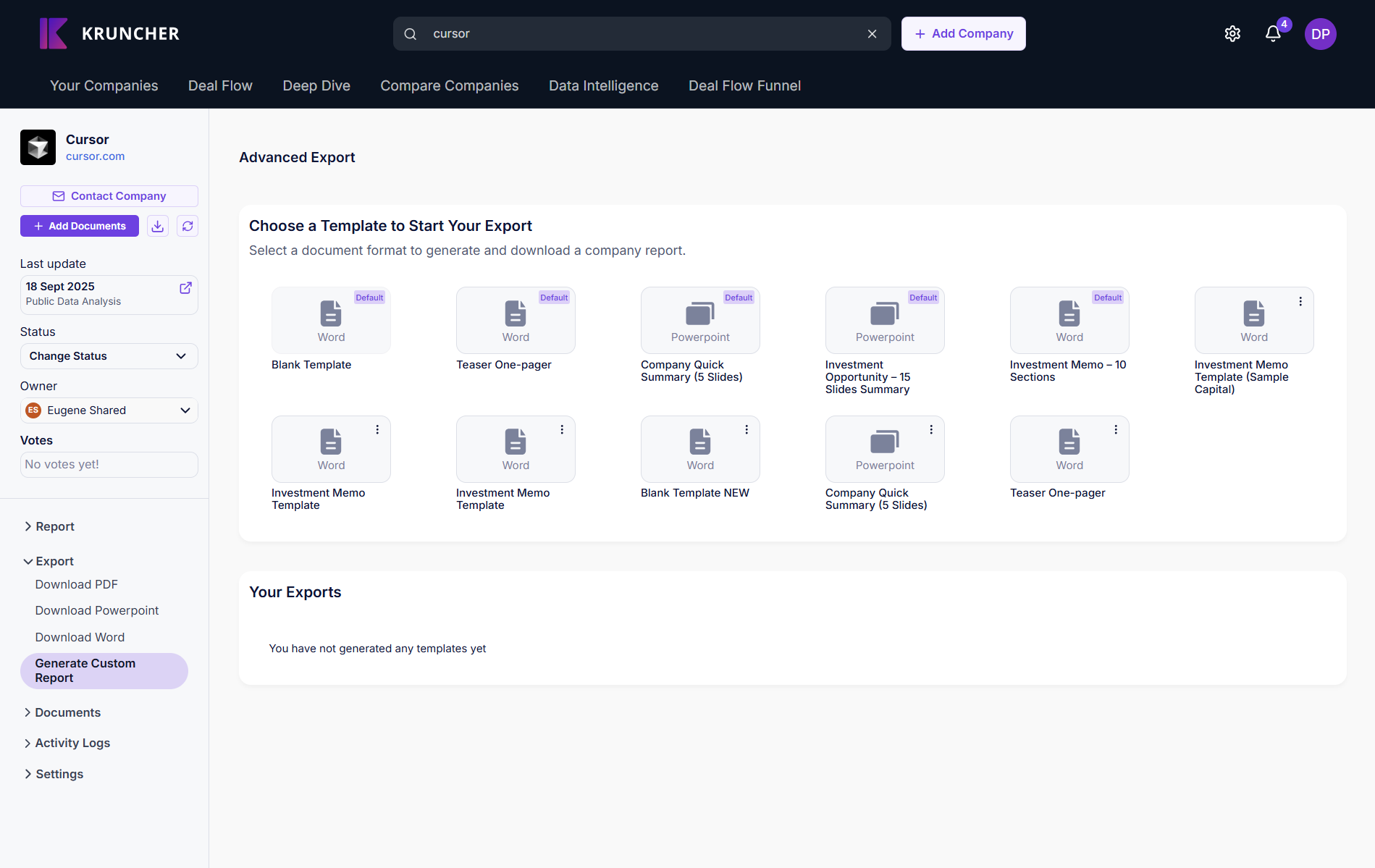

Creating Custom Templates (IC Decks, LP Reports, Investment Memos)

When exporting company reports and memos, you can export into Word or PowerPoint file using your own custom templates.

Select "Generate Custom Report" on the left bar and you will see some default template options.

You can customize and select the information that Kruncher will make as pages/slides, and what each slide contains.

Click here to learn more about customizing export document templates.

Once everything is to your liking, click "Save As a New Template" to make this configuration as a template for you to use in the future.

Alternatively, you can also upload a template from an existing document. Kruncher will learn its logical structure and order, and you will get investment memos, LP reports, and more in a structure you're familiar with, ensuring minimal editing on your end.

Note that this does not include aesthetic changes such as heading, font types, and brand colors.

Update, replace, or remove your templates whenever you like. Your templates stay saved and your original file stays private.