Set Kruncher on your personal investment criteria by choosing focus areas and dealbreakers to make Kruncher flag whether a startup aligns with your investment criteria. This helps you quickly spot companies that match your criteria, and ignore ones that don’t.

This investment criteria can be changed anytime, so as you refine your investment strategy, you can easily update your criteria and Kruncher will apply it automatically to new startups.

Invited team members in your fund will be aligned on the fund's criteria, avoiding confusion or subjective interpretation.

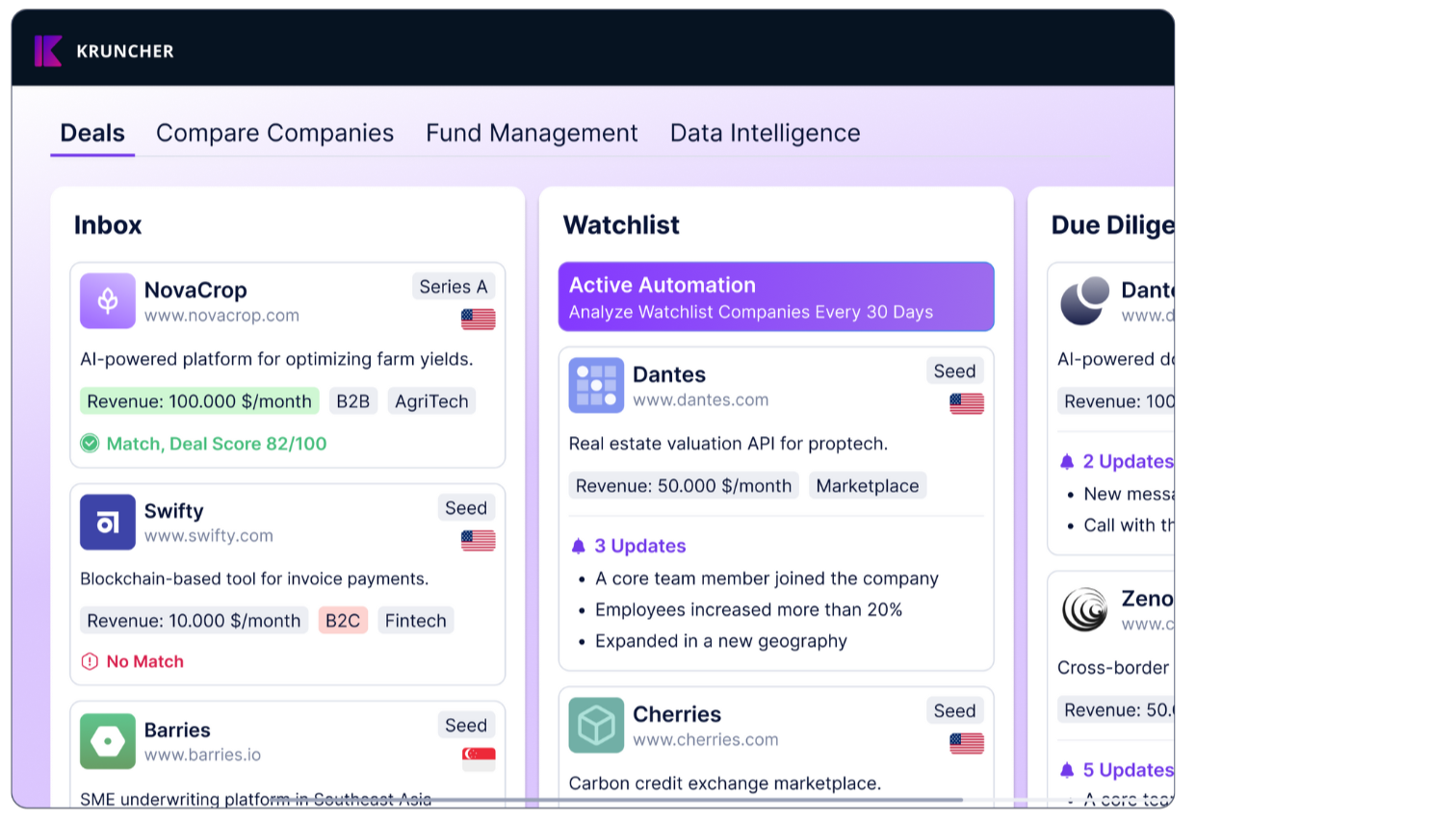

In your dashboard, Kruncher will display a Match or No Match tag based on how well each company aligns with your criteria.

This guide covers how to set up your investment criteria in Kruncher for the first time, as well as to edit your criteria in the future.

Setting up your Investment Criteria

1. Go to Settings → Investment Criteria

From the Home page (https://kruncher.ai/app/home), click on Settings (x) in the upper right corner beside your profile.

Select Investment Criteria on the left side of the Settings page.

2. Create new version → Set up criteria

Click the button Create new version. This will open a full-screen pop-up to start the configuration process.

NOTE: If you do not skip the set-up when you first created your account, you will already see the configuration you chose (labelled "Version 1/2/3... created by [Your Name]"). You can create multiple investment criteria and select previous versions with the drop-down arrow.

New investment criteria will only apply to future analyses. Existing company reports under a previous criteria will remain unchanged.

Click Set Up Criteria to start selecting your preferences for Business Model, Stage, Geography, Industry, and Revenue Profile. On the next page, you’ll define how important each option is by marking it as a Focus, Neutral, or Deal Breaker.

Here is how Kruncher defines Focus, Neutral, and Dealbreakers:

Focus – Signals a strong preference. Companies that match your Focus areas will be marked as a Match.

Neutral – You’re open to these, but they’re not a strong signal either way. Companies with these traits will still be shown.

Dealbreaker – Hard exclusions. Companies with these characteristics will be flagged as No Match, helping you avoid deals that don’t fit your thesis.

3. Define each of the 5 sections under Investment Criteria

When setting up your Investment Criteria, you will configure five areas: Monthly Revenue Range, Company Stage, Business Model, Industry, and Geography.

NOTE: These are the 5 default categories for investment criteria. Implementing new custom set(s) of categories and parameters is available for our Enterprise users. Contact our team for more details.

1. Monthly Revenue Range: Set the ideal monthly revenue range for startups you typically consider. This helps Kruncher filter companies by traction level (pre-revenue, early revenue, or scaling).

Click Next when you're done to go to the next category.

2. Company Stage: Select the stages (e.g., Pre-Seed, Seed, Series A) that align with your fund’s mandate. This defines the maturity level and typical risk profile you're comfortable with.

Click Next when you're done to go to the next category.

3. Business Model: Select the types of business models you focus on. Kruncher uses this to flag mismatches and prioritize relevant deals.

Click Next when you're done to go to the next category.

4. Industry: Select which industries you prioritize (e.g., Fintech, Healthtech, Climate). You can also be more specific and expand each industry sector and flag its sub-sectors.

Click Next when you're done to go to the next category.

5. Geography: Finally, indicate the regions or markets you invest in.

There is also a quick preset to Focus on European Union countries or set Dealbreakers for blacklisted companies.

List of countries in the European Union: Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden.

List of countries that are blacklisted: Afghanistan, Burundi, Central African Republic, Congo, Cote d'Ivoire, Cuba, Eritrea, Guinea, Guinea-Bissau, Iran, Iraq, Lebanon, Liberia, Libya, Mali, Myanmar, North Korea (DPRK), Sudan, Syria, Venezuela, Yemen, Zimbabwe.

NOTE: Blacklisted countries are based on countries under Embargoes and Other Special Controls according to the US Department of Commerce's Export Administration Regulations (EAR), CFR 746.

Click Next to save all your preferences.

Once you complete these steps, your new investment criteria will be created and selected automatically.

NOTE: New investment criteria will only apply to future analyses. Existing company reports under a previous criteria will remain unchanged.

See it in action

1. Go to your homepage.

2. In the Table view, you will see whether a company is Match or No Match in the Investment Criteria column.

3. In the Board view, you will see the label on each individual company under your Inbox column.

NOTE: Depending on how many companies you have uploaded into Kruncher, it can take up to 15 minutes for Kruncher to process your companies and assign them Match or No Match with your newly set Investment Criteria.

Next Steps

Next, learn how to understand what deal score is and how to customize Kruncher to work with your scoring framework.