I need to tell you a story a friend told me 5 years ago that still occupies the back of my mind.

Five years ago, he sat across from a founder in a café in Palo Alto. Smart guy, solid team, decent product, but they were pre-Series A, burning through cash, and frankly, too early for his typical check size. You know the conversation. "Really interesting, let's definitely stay in touch, would love to see how you're progressing in six months."

He walked away thinking they had potential but needed more time to prove themselves. He added them to his watchlist.

Fast forward eighteen months: He’s scrolling LinkedIn and saw their Series B announcement. $40M round, led by Andreessen Horowitz. The same founder he’d bought coffee for was talking about their 8x revenue growth and three Fortune 500 customers they'd signed.

Regret, he said, always comes in hindsight.

The Uncomfortable Truth About Watchlist Management

Here's what happened in those eighteen months while he wasn't paying attention:

Month 3: They pivoted from horizontal to vertical SaaS

Month 6: They hired a VP of Sales with serious enterprise experience

Month 9: They closed their first seven-figure deal

Month 12: They started hiring engineers aggressively

Month 15: Industry publications began covering their customer wins

Every signal was there. Every development was public. He just wasn't systematically watching.

This story isn't unique. I've heard variations from dozens of partners. We all have that company that "came out of nowhere" except it didn't. We were just not paying attention consistently.

Why Smart VCs Are Terrible at Watchlists

I've talked to hundreds of VCs about their watchlist management. The pattern is depressingly consistent: initial enthusiasm, elaborate tracking systems, then gradual abandonment.

Our previous article shows that 85% of VCs completely abandon their watchlists within six months. We start with good intentions: creating Notion databases, setting calendar reminders for quarterly check-ins, promising ourselves we'll "stay close" to promising companies.

Then the daily ops gets to us. New deals demand attention. Existing portfolio companies need support. The day-to-day urgencies of venture capital crowd out the longer-term relationship building that actually drives superior returns.

But the most successful investors I know have a completely different relationship with their watchlists. They don't just maintain them. They systematically cultivate them.

The Compound Interest of Attention

Warren Buffett talks about compound interest in capital. The best VCs understand compound interest in attention.

Warren Buffett talks about compound interest in capital. The best VCs understand compound interest in attention.

Every interaction with a watchlist company builds on previous interactions. Every development you observe adds context to your understanding of the founder's capabilities and market dynamics. Every conversation references shared history rather than starting from scratch.

When you've been following a company's journey for eighteen months, you can have substantive discussions about their strategic challenges, competitive positioning, and growth trajectory. You're not just another investor trying to understand their business during a three-week fundraising sprint. You're someone who's been paying attention.

Founders notice this. They remember investors who understood their evolution story, not just their current metrics.

The Information Asymmetry Tax

85% of watchlists fail because the manual workload is impossible to sustain.

Meanwhile, the top-tier funds have quietly solved this problem. They have dedicated teams for market intelligence and prospect tracking. When a company starts showing real traction, these funds already have months or years of relationship history, detailed understanding of the founder's journey, and context about strategic evolution.

They're not trying to build rapport in three weeks. They've been building relationships for years.

This creates what I call the "information asymmetry tax": the premium you pay for competing with incomplete information against funds with comprehensive market intelligence.

When you're frantically trying to understand a hot company's business model while Sequoia has been tracking their progress for two years, it's not a fair fight.

The Automation Breakthrough

But something fundamental has changed: the manual intelligence gathering that was impossible to scale is now systematically automatable.

But something fundamental has changed: the manual intelligence gathering that was impossible to scale is now systematically automatable.

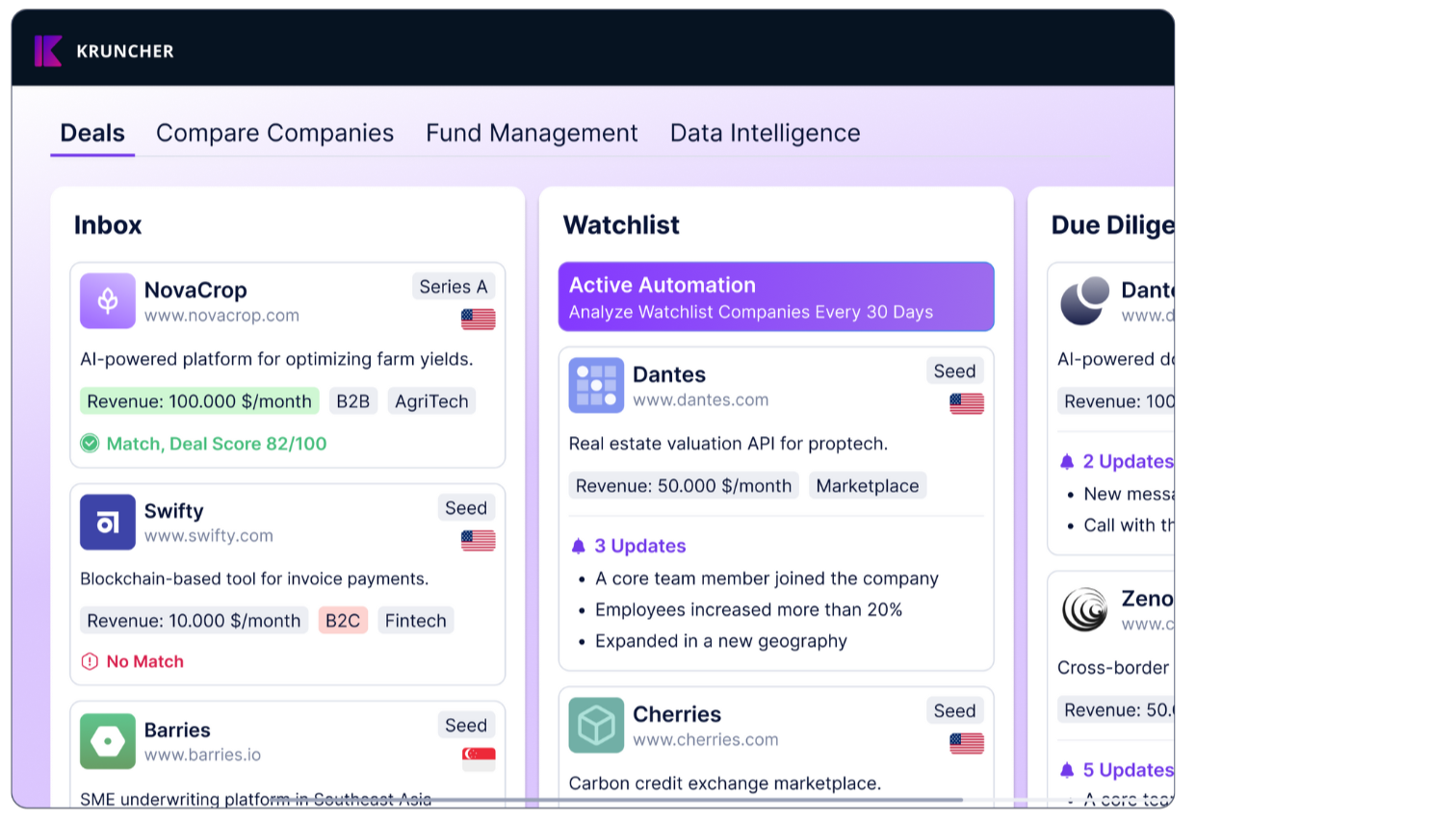

Kruncher's Watchlist Automation solves the core problem that kills manual tracking: the time investment required for continuous monitoring.

How it actually works:

You set your tracking preferences for each watchlist company: monthly or quarterly updates, specific signal types you care about, alert thresholds based on your investment criteria. Kruncher then continuously monitors these companies across multiple dimensions:

Team Evolution Tracking: Executive hires, key departures, hiring velocity patterns, employee satisfaction signals, board composition changes, advisor additions.

Product Development Monitoring: Feature launches, pricing changes, customer testimonials, partnership announcements, technical milestone achievements, competitive positioning shifts.

Market Momentum Indicators: Customer acquisition announcements, revenue growth signals, market expansion activities, industry recognition, thought leadership development.

Strategic Development Signals: Funding preparation indicators, pivot announcements, technology stack changes, regulatory compliance updates, M&A positioning.

The system doesn't just collect this information, it learns which signals matter most for your specific investment thesis and adjusts its prioritization accordingly.

Pattern Recognition at Scale

The most valuable aspect isn't individual company tracking. It's pattern recognition across your entire watchlist.

When you're monitoring 50+ companies simultaneously, you start seeing patterns that are invisible when tracking companies individually. You notice that successful enterprise SaaS companies follow similar hiring sequences. You identify early warning signs that predict which consumer companies will struggle with unit economics. You develop market timing intuition from watching multiple companies navigate similar challenges.

Kruncher's comparative analysis engine identifies these patterns automatically. When three different companies in your watchlist all hire VPs of Sales within a short timeframe, that might signal an inflection point in the market worth investigating.

Kruncher is one of the most used tools for data-driven VCs.

Read the Data Driven VC Landscape 2025 report here.

The Relationship Compound Effect

Systematic watchlist management enables what I call "relationship compound interest"—the exponential value that comes from consistent engagement with promising founders over time.

When you've been following a company's journey systematically, you can reference specific developments that impressed you, ask informed questions about strategic challenges, and demonstrate genuine understanding of their evolution story.

Kruncher makes this possible by maintaining complete interaction histories for every watchlist company. Meeting notes, email exchanges, founder conversations. All contextualized within the company's development timeline.

When a company hits significant milestones, you immediately see your relationship history and can identify optimal re-engagement opportunities. No more awkward "remind me where we left off" conversations.

The Predictive Intelligence Advantage

By monitoring multiple signals simultaneously, systematic watchlist management often reveals funding rounds and strategic developments months before they become public.

When a company starts hiring a CFO, adds board members, and announces several enterprise customer wins within a short timeframe, experienced VCs recognize this pattern as funding preparation. With systematic monitoring, you get advance warning rather than learning about opportunities through press releases.

Kruncher's intelligence engine is designed to identify these patterns. The platform connects dots across seemingly unrelated developments to surface insights that might take weeks of manual research to uncover.

The Network Effects of Systematic Tracking

Once you start tracking companies systematically over time, something interesting happens: your watchlist becomes a network intelligence system.

Once you start tracking companies systematically over time, something interesting happens: your watchlist becomes a network intelligence system.

You begin to understand how different companies relate to each other. Which ones are complementary, which ones are competitive, which founders know each other, and which market segments are connected.

This network understanding becomes valuable for your existing portfolio. When a portfolio company needs enterprise customers, you might know three watchlist companies that could be perfect fits. When you're considering a follow-on investment, you have context about competitive dynamics from watching adjacent companies evolve.

The Compound Decision Framework

Every great investment decision is really a series of smaller decisions made over time:

- The decision to meet the founder initially

- The decision to add them to your watchlist

- The decision to maintain consistent attention

- The decision to re-engage at key milestones

- The decision to participate when they're ready to raise

- Et cetera.

Manual watchlist management breaks down somewhere in this sequence. Systematic automation makes the entire chain possible without you spending 90 hours every month.

Why This Matters More Than Ever

The venture capital industry is becoming increasingly competitive. Founders have more investor options than ever. The best opportunities often go to investors who've been paying attention longest, not those who show up with the biggest check.

The firms that consistently get into the best deals are the ones with the best information about emerging opportunities.

Systematic watchlist management enables just that. It’s building sustainable competitive advantages through superior market intelligence.

The Future Belongs to the Systematically Prepared

The companies you should be investing in tomorrow are probably on someone's watchlist today. The question is: whose?

If you're ready to stop missing opportunities because you weren't paying attention, systematic watchlist automation makes it possible to track promising companies at scale without the impossible time investment that manual monitoring requires.

Try Kruncher's Watchlist Automation with your most promising prospects. For a limited time only, use code 400HOURS on checkout to get 400 hours worth of investment analysis. Offer ends 15 June 2025.