As a VC partner, you're responsible for 15-20 portfolio companies. It can get tough to keep tabs on them regularly as your day-to-day stuff leaves you exhausted. But you have to keep at it, because of all the what-ifs, and you can’t miss on the next potential unicorn.

I learned this the hard way when a Series A company in my portfolio quietly began shifting their engineering team to focus on a completely different product. By the time it surfaced in our quarterly board meeting, they'd burned through six months of runway on a failing pivot.

The signs were there. Engineering job postings had changed, website messaging had shifted, key team members had left… but I'd missed them all in the daily noise.

This experience taught me that systematic portfolio monitoring is essential.

But, how often should VCs monitor portfolio?

Let’s explore that question, and here’s the comprehensive VC checklist (that can act as a VC portfolio tracking template) I now use to track portfolio companies across different time horizons.

Daily/Every other day Monitoring

Daily/Every other day Monitoring

Time Spent: No more than 5 minutes per company.

A brief daily scan of the company. Check the group chat, their Linkedin, their socials, etc. The surface level stuff. The purpose is to get a first layer pulse check of the company. If something smells fishy even at the most surface, public state, then it’s your cue to investigate further.

Some of you may also ask: Isn’t monitoring daily overkill? Honestly, it depends on what level of partner you are. If you’re just starting out, it’s important to build the habit and be an active investor (as active as you can be, anyway). If you’re more senior, then it’s understandable that you don’t have the time to do daily monitoring.

On your daily scan, focus on:

Market Presence

Look out for News mentions: Press releases, media coverage, partnership announcements. This is the company’s public image and it shouldn’t be far off from what you know internally.

Also watch for Social media spikes: Unusual activity levels on company channels. This could indicate that something is going on, especially if it doesn’t align with what you remember from your quarterly check-ups.

Team Movements

Watch for team signals. Look at the company’s LinkedIn activity, any departure signals, and team expansion patterns. They indicate growth or stress signals when key employees update their profiles to "looking for opportunities", for example. Sudden hiring spurts or freezes in specific departments are also symptoms you shouldn’t ignore.

The point of checking in daily is being present. If something is majorly wrong until it’s shown in social media, then you should know before hearing it from your colleagues.

Weekly Reviews

Weekly Reviews

Time Spent: 15-20 minutes per company.

Weekly is your time to do a deeper analysis that helps you spot trends that daily scans might miss. You can dive deeper into how their product is moving, their traction, and any churn indicators.

For these longer reviews, dedicate your attention to:

Where is their Product now?

Look out for feature launches, technical milestones, and pricing experiments of their product. This should give you an idea of whether the product is moving along according to the direction and timeline you know. This also tells you how agile the company is. If they post new things about their product often, that means they’re building fast.

But don’t take it as the holy grail. Core capabilities aren’t built in a day. If they ship out small, vanity features more often than doing important bug fixes for example, it could be a sign that the product’s trajectory is losing focus.

What do customers think?

If made accessible to you, you should also see customer patterns and behavior when using the product. Do they love it? Are they paying for it? What’s their churn rate? MAU/DAU trends?

This gives you a deeper insight into whether the company is going towards PMF, if they haven’t already. It’s also a great indicator of the company’s trajectory.

What are competitors doing?

Be on the lookout for competitor announcements, new feature launches or partnerships that may potentially threaten your portfolio company. A wider scan of market dynamics in that specific industry that could impact your investment can also be useful.

Ultimately, get an overall sense of where the company is relative to other players in the same market. Are they ahead, or behind? Who is on track to gain market share?

In a weekly scan, you’re looking for signals that help you project the next quarter, up to a year. This is also where documenting your observations can be useful when you review the company a month/a quarter later.

Monthly Deep Dives

Monthly Deep Dives

Time Spent: About 1 hour per company.

Monthly analysis reveals deeper patterns and strategic shifts. This is where you zoom out the most and investigate the core foundations and high-level ideas the company is embodying.

In these deep dives, examine:

What is their Market Position?

An extension to the weekly competitor scan, you ultimately want to see signals of where they are on market share. Ask the founders how many customers they serve and compare that to TAM/SAM. Compare with competitors/incumbents’ market share.

For earlier portfolios, PMF signals are your go-to since that will eventually lead to gaining more market share. Look for revenue distribution across client base, customer longevity, LTV and renewal patterns. Customers only love something when they pay consistently for it.

The questions you want to ask yourself: Who is on track to gain market share? Is it your portfolio company? If not, why?

How is the Team?

Monthly is a good frequency to monitor the frequency of new hires and turnovers. What kinds of roles are being hired? Are the department ratios (Engineering-to-sales, product-to-customer success) appropriate?

Importantly, how are the senior management feeling? Is everyone present, active, and excited? Talk to them, ask what’s going on, and what their thoughts are of the company’s future. You do not want to be blindsided by a sudden C-suite shakeup that will destabilize the company’s trajectory and morale.

How are they doing Financially?

This could be hard to do monthly if all you have access to is the annual books or audit. But you should be able to infer a lot of concrete information based on hiring spend, marketing spend, R&D spend, etc. Are they getting a good revenue per dollar raised ratio? Are their unit economics sustainable?

Also, ask about CAC, LTV, and gross margin trends. Good founders should know a pretty good estimate of these things any time you ask them. These numbers essentially tell you whether the business model makes sense or not.

Add on top of your weekly journal about the things you observe here. Be more detailed and include bullet points of trends and patterns you sense.

Quarterly Board Prep Checklist

Quarterly Board Prep Checklist

All of that periodical monitoring comes down to the quarterly meeting. With all your observances and data in one place, spend about 30 minutes before the meeting to formulate a clear picture of the company in your head:

Are they moving in the right direction?

Startups often pivot, try out new things, hire and re-hire, especially when they’re early. It’s natural. But pivoting too many times is a sign of trend-chasing as their business model, not building something sustainable and evergreen.

Here, watch for where the company stands versus competitors. Do threat assessment for new entrants. Naturally, consider the company’s moat. Has there been defensibility improvements, or erosion?

Are they focused on the right problems? Are they executing cleverly?

Are they moving according to timeline?

Besides going in the right direction, companies must also get there fast. Compare the company from the previous quarter. What have they achieved in 3 months time? What are their KPIs and are they on track, or behind, or even ahead? How has the company utilized investor funds?

Are they moving fast enough? Or are they stuck in the same problem as 3 months ago?

Can their internal team withstand the test of time?

If everything is going well, take a hard look at the team. The culture that the founders enforced. How key employees feel. The types of talent that stayed and left.

Great products are made by great people. If management is showing red flags, the company can implode from the inside, even though everything else is perfect.

As the startup journey gets tougher and tougher, the founder’s integrity is constantly tested. Don’t take this for granted! Watch how founders and senior management perform under pressure. Do they stay honest and humble, or do they try to hide things and cut corners?

If you’re not careful, death by a thousand cuts is a real thing.

“Reporting for LPs takes days of my time every quarter”

— Costanza, 2B AUM VC in Europe and China

Now, how do I actually go about doing this?

Let’s dive into the weeds now. Let’s assume you’re monitoring 20 companies, and you need to review 30 proposals per day. Let’s do a simple run-down of how doing this VC checklist can look like, in a 50 hour week schedule.

Every day:

-

Daily monitor 10 companies (so you monitor all 20 companies every other day)

-

5 minutes x 10 companies = 50 minutes

-

-

Weekly monitor 4 companies (so you monitor all 20 companies per week)

-

20 minutes x 4 companies = 80 minutes

-

-

Monthly monitor 1 company (so you monitor all of them in a month, working 22 days per month)

-

60 minutes x 1 company = 60 minutes

-

-

Reviewing 10 proposals

-

10 minutes x 20 proposals = 200 minutes

-

-

Attending standups and meetings

-

30 minutes x 3 meetings = 90 minutes

-

-

Documentation/writing things down = 60 minutes

-

Writing emails and other admin work = 30 minutes

Time spent total = 9 hours and 30 minutes. With lunch for 30 minutes a day, it’s a very tight 10 hours of work.

Purely for monitoring and documenting what you see, you’ll need to spend 4 hours and 10 minutes daily.

Per month, you’re spending 91 hours and 40 minutes just on monitoring.

And if you have more than 20 proposals to review daily, or spend more than 10 minutes per proposal?

Ouch.

A Better Way than this

This VC checklist represents the gold standard for portfolio monitoring, but let's be realistic: manually tracking all these metrics across 20 companies requires 20+ hours per week. Most partners just don't have that bandwidth, and if you put in 12 hour days (or even more) consistently, burnout is imminent.

But it’s not to say that you should monitor less. Instead, monitor smarter. Whether through dedicated analysts, automated tools, or a combination of both, systematic portfolio monitoring is no longer optional in today's competitive venture landscape.

The firms that excel at portfolio monitoring catch problems earlier, make better follow-on decisions, have their partners less fatigued, and ultimately generate superior returns.

The real question isn't whether to monitor your portfolio this comprehensively. It's how to do it efficiently without sacrificing your other responsibilities.

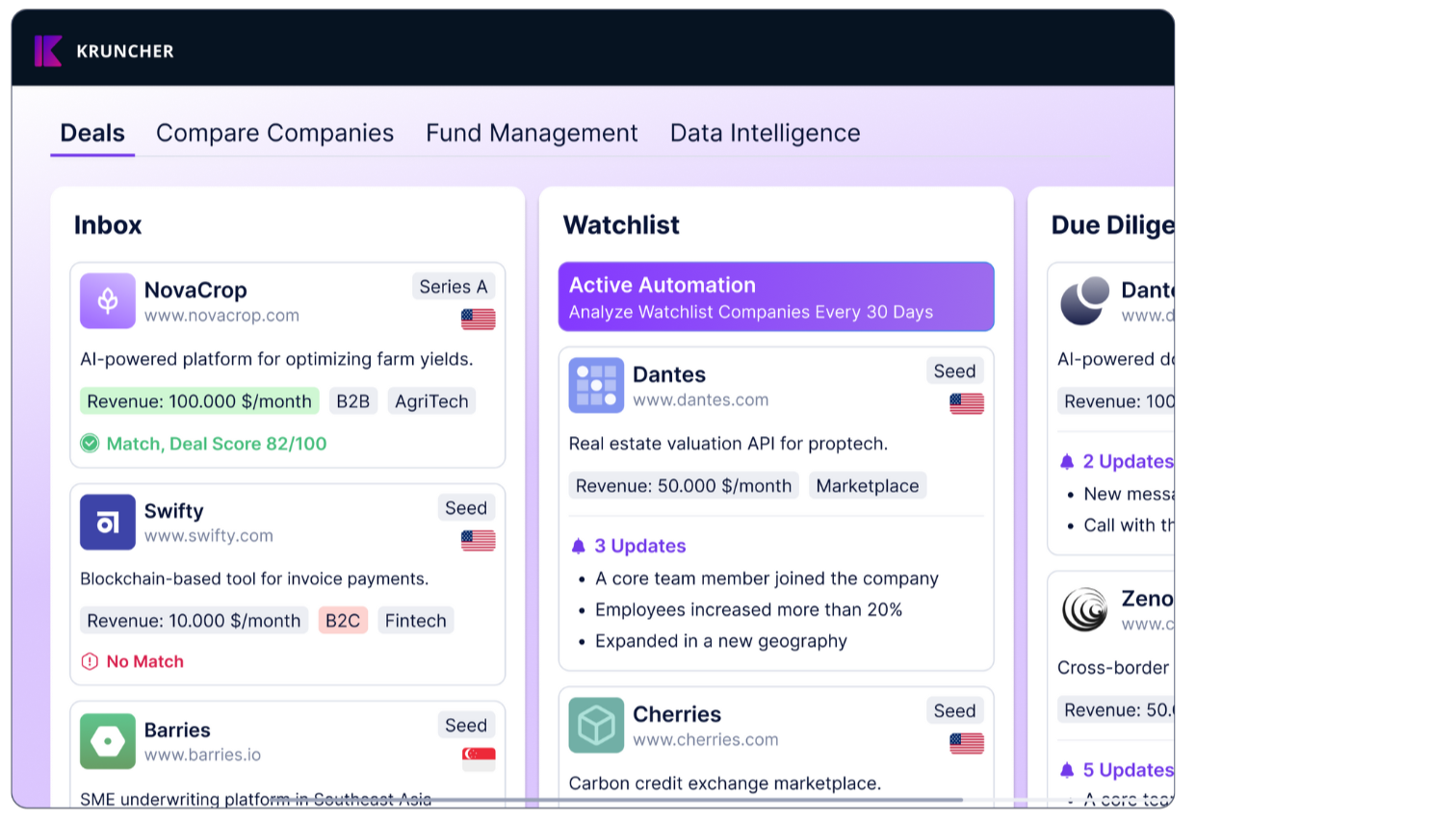

You can automate all that busywork with Kruncher, the AI Analyst and automation tool specifically designed for VCs and private markets.

What is Kruncher?

What is Kruncher?

Think of Kruncher as an analyst that does all the monitoring you, but it runs 24/7 and never gets tired.

All those 20 companies you need to monitor? Set Kruncher up to do monitoring of portfolios in your watchlist. Get email notifications only when something stands out.

Then, whenever you need to check how a company is doing, simply go to their report page and find what you need. It is always the most updated version.

No more spending 4 hours a day on monitoring and documenting what you observe. Kruncher does all of that for you, and since it has the internet as its knowledge base, it has pretty accurate benchmarks of many different aspects of your portfolio.

That’s how it can be intelligent and knows what’s important to ping you about, and what’s not so important and keep it to the background.

Another pain that Kruncher solves is being the one source of truth.

Another pain that Kruncher solves is being the one source of truth.

You don’t need to have 20 tabs and windows open of emails, WhatsApp, Slack, Notion, Google Sheets, PDFs, and others when you want to recall information, scrolling endlessly to find that one thing.

Most of the time, it’s not where you remember it to be. Most of the time, it’s not even there at all.

You don’t deserve that. Simply integrate Kruncher with all your information sources and view it all on Kruncher.

Now, you only need to have one tab open (Well, two. The other one is Google Meets with your LP).

Is that all?

Is that all?

Well, no.

Kruncher has so many other useful features outside of its intelligent, automated portfolio monitoring.

But this article is going to be very long and very tedious if I go through all of them one by one.

Instead, here’s a list of Kruncher’s other features that might interest you:

- What a Report looks like (Sample Report)

- Automation and AI Agents for VC

- Comparison Table (Human Analyst vs. ChatGPT vs. Kruncher)

Share with your colleague if you think this article is interesting.

Alternatively, you can try Kruncher yourself! The first 5 company analyses are completely free, no credit card required.

See how Kruncher can save hours of your time daily. Thank me later.