It can be difficult to be continuously up-to-date with how potential companies are developing. You want to monitor how they do over time, but this is easier said than done.

Starting today, Kruncher has released a Deep Dive view on your watchlist companies, to give you an even better idea of companies in your watchlist that are growing, not growing but not declining (stable), those that are declining, and those declining dangerously.

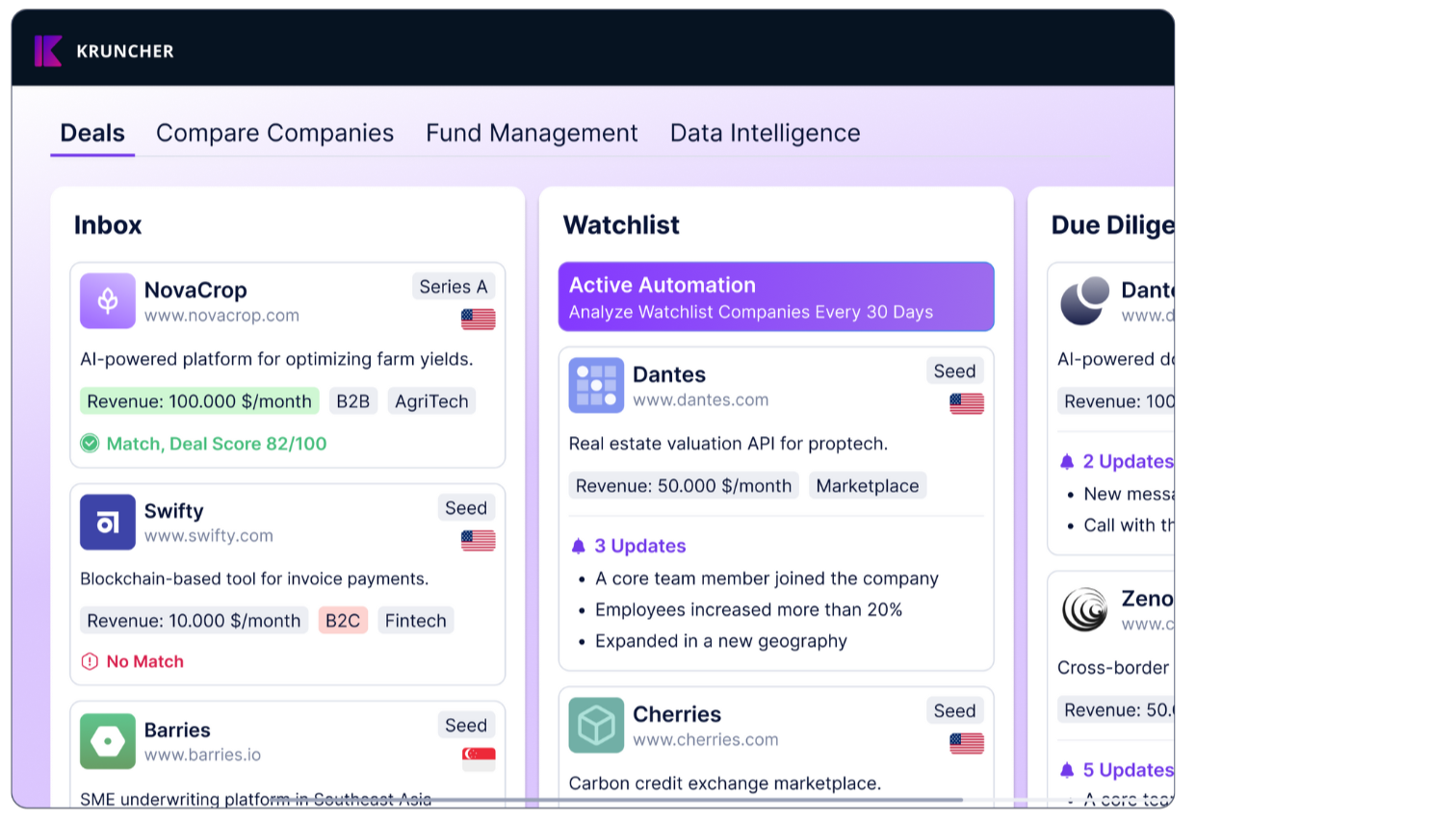

This is what that view looks like:

Let’s learn the exact definitions of each category.

Let’s learn the exact definitions of each category.

All of these categories are based on your Growth Score, which is set by you in the Settings.

Growth Score is a percentage number (%), both positive and negative. The higher the number, the better and faster growth rate that company is showing. Negative numbers means the company is de-growing, or in other words, declining.

By metrics set by you, each company is automatically assigned one Growth Score.

Every category here is based on your growth score threshold, which you also set yourself. As a baseline, Stable is a Growth Score of 0%.

As an example, let's define Growing companies as any company that has a Growth Score above 20%. This means that companies will only be categorized as Growing if it has a Growth Score above 20%.

Next, let's define Declining companies as any company that has a Growth Score below 10%. This means that companies will only be categorized as declining if it has a Growth Score lower than -10%.

That means, every company with a Growth Score in the range of -10% and 20% is defined as Stable.

Critical Events is a subset category of Declining. Companies in this category have specific triggers that put it in this category, such as a C-suite leaving, or facing a big lawsuit... signs that could be a rapid downturn of the company. You can also customize these triggers, though we won’t be delving too much into the Critical Events category for now.

Summary: Based on this Growth score, we automatically label companies as GROWING, STABLE, DECLINING, and CRITICAL EVENTS. These labels appear across your views, making it easy to spot trends and prioritize actions. It's a fast, clear way to track company momentum at a glance.

How to Categorize Companies into “Watchlist”

Because this Deep Dive view is only for your Watchlist, I will first walk you through how to categorize companies into the Watchlist category first. (Feel free to skip this process if you already have companies in your Watchlist column)

In the Main board tab (this is the default tab), select Board view on the top right if you haven’t already. This view makes it easier for you to see if you have any companies that are in that Watchlist category.

There’s two ways of changing the category of a company to the Watchlist.

There’s two ways of changing the category of a company to the Watchlist.

The first and easiest way is to simply drag and drop the company to the Watchlist column.

The second way is switching to the Table view, and clicking on the company’s Stage data. Here, a popup will appear and you can assign it as Watchlist, and also include your reasons and comments for why you decided to put that company into the new category.

When you’re done, click the Save button.

When you’re done, click the Save button.

Repeat this process for every company that you want to make part of your watchlist.

How to Setup Your Growth Score Framework

Now, let’s learn how you can set up this Deep Dive view for your watchlist.

The first thing you need to do is define your Growth Score Framework.

First, click the Settings Icon (⚙️) on the top right corner. In this Settings page, click on the Growth Score Framework on the left tab.

This is the view that you will see. By default, Kruncher already set some metrics to calculate your growth score, but everything here can be customized as you like so Kruncher calculates Growth Score according to your definition of growth.

This is the view that you will see. By default, Kruncher already set some metrics to calculate your growth score, but everything here can be customized as you like so Kruncher calculates Growth Score according to your definition of growth.

Let’s look at those customization options now. (1) You can cick + Add Growth Metric to add another metric of growth. A popup will appear, asking you to pick the metric and its weight in percentage. A bigger weight means that metric matters more as a growth metric than others.

NOTE: Total weights cannot exceed 100%.

Next, you can (2) edit or delete existing metrics on the Actions column.

Then, your Reference Values is that growth score threshold that I wrote about earlier. (3) This is where you set the threshold for when Kruncher should assign companies as Growing or Declining other than Stable.

Then, your Reference Values is that growth score threshold that I wrote about earlier. (3) This is where you set the threshold for when Kruncher should assign companies as Growing or Declining other than Stable.

After you made all the changes you want, press the Save Edits button on the bottom right.

The Growth Score Framework is different from the Deal Score Framework. Read our guide about understanding and setting up your Deal Score and Investment Criteria here.

How to access the Deep Dive Watchlist View

After the setup is done, you can access the view by (1) clicking on the Deep dive tab next to Main board tab and (2) clicking the Watchlist tab below it.

By default, you should already see 4 categories of Growing, Stable, Declining, and Critical Events, all color-coded like the above.

By default, you should already see 4 categories of Growing, Stable, Declining, and Critical Events, all color-coded like the above.

NOTE: If the view is blank and you don’t see the categories above, click on the + Add Cluster button and manually set up the categories. If you still don’t see this option, email us at info@kruncher.ai for support.

(3) If you click on the Settings Icon (⚙️) of each category, you can edit this category’s display (We call them Clusters) to change the color, description, and order.

Most importantly, you can set Kruncher to send you a notification email when a company is added to the category by clicking on the toggle at the bottom. We recommend you to set this notification on for Growing Companies and Critical Events companies.

Above the categories, Kruncher also shows you the distribution of your watchlist companies’ Country, Stage, Business Model, and Industry. Customization for this distribution is coming soon.

We hope that you can successfully set up this insightful view to help you monitor easier and make timely decisions for your investments.

What makes Kruncher truly different from other private market CRM/tools is the easily customizable parameters it has to make it work exactly like how you and your fund thinks.

If you have any further questions that are not answered in this guide, please contact support at info@kruncher.ai and we will respond to you as soon as possible.