This article first appeared in Paulina's Substack (HardTech VC) on June 2nd, 2025 and is reposted here with minor edits.

Everyone says we are data-driven and tech-savvy. But if you look behind the curtain, most VC processes are still shockingly manual.

‘You Can’t Be Data-Driven with 42 Tabs Open!’ they say, and they are right!

We talk about offering “value-add,” but how much of that value and human power is still buried in spreadsheets, emails, and manual workflows?

In a world where AI is literally reshaping every profession (check the news!) — from law to medicine to creative work — venture capital remains strangely analog. While some CVCs are shutting down and traditional firms are re-registering as RIAs to explore buyouts, secondaries, and public equities, the venture process itself is lagging behind.

Fundraising, sourcing, diligence, portfolio support — still a maze of Notion docs, Airtable databases, Slack threads, and decks flying around. I’ve tested dozens of VC tools. Most of them solve one small problem well…maybe two, but I don’t really want 100 siloed tools. I want one platform that thinks like an investor and until recently, I was still having 42 tabs open and trying to make sense of all the pieces of info all at once.

Fundraising, sourcing, diligence, portfolio support — still a maze of Notion docs, Airtable databases, Slack threads, and decks flying around. I’ve tested dozens of VC tools. Most of them solve one small problem well…maybe two, but I don’t really want 100 siloed tools. I want one platform that thinks like an investor and until recently, I was still having 42 tabs open and trying to make sense of all the pieces of info all at once.

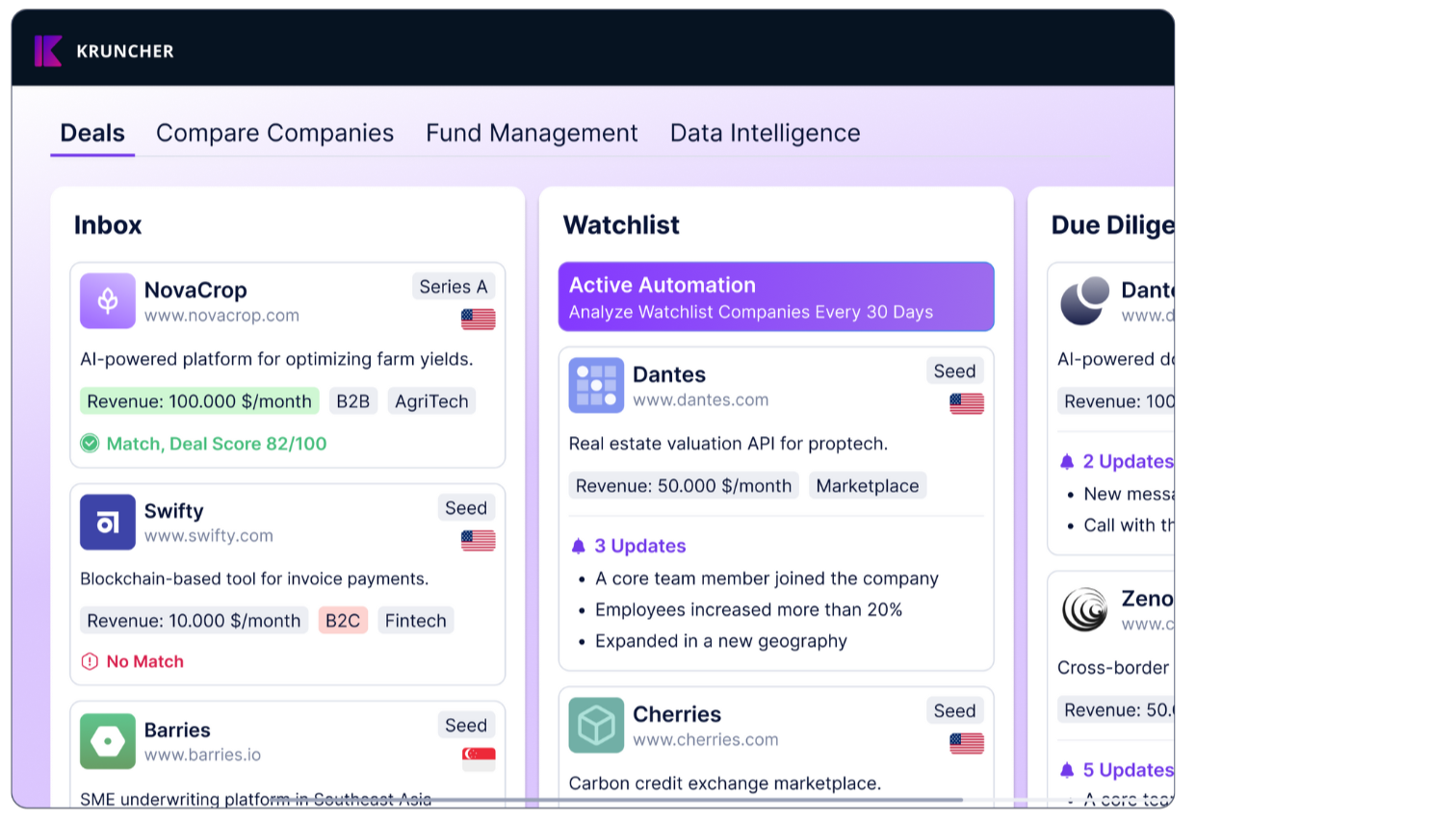

Accidentally, I came across Kruncher, and I was amazed by how smart the platform is and how much time it saves!

Kruncher isn’t just another CRM or data scraper. It’s an AI-native command center for venture investors — built to aggregate, analyze, and act faster.

➡️ It checks decks from your emails and tells you which ones are relevant. How cool is that?! 👀

How many times have you wanted to respect founders’ time and at least send a quick thank-you to acknowledge their outreach — yet never found the time to do it? 🤔

➡️ Kruncher sends automated emails either requesting more info or politely saying “no, thank you,” which is just basic decency.

How many times have you promised yourself you’d follow up in a few months because the stage was too early — only to forget, and then see the company raise a big round you missed out on?

➡️ Kruncher sends automated emails to watchlist companies and independently monitors the news, alerting you with growth signals based on events you define as important.

➡️ Kruncher has access to both private and public startup data. It ingests your notes, recordings, emails, and conversations — and updates your CRM automatically.

➡️ It auto-generates deal memos and templates.

➡️ It provides structured summaries for investment committee (IC) discussions.

How much time do you spend putting together LP reports every quarter?

➡️ Kruncher automatically generates and sends quarterly updates to your LPs — pulling in the most up-to-date internal and external(!) data. No news goes unnoticed.

It’s a centralized knowledge hub that’s constantly refreshed with news, data, notes, and call summaries — this isn’t just another static tool.

💡 Most importantly, Kruncher augments, not replaces. The human side of venture — conviction, trust, and emotional intelligence — is irreplaceable. But the repetitive, slow, admin-heavy parts? That’s exactly where AI should step in. Kruncher gets that balance right.

I like how Mark Andreessen and Ben Horowitz frame the future of VC: it’s all about people and it has always been more art than sicence. But to be truly human-centric, we need to stop wasting time on copy-paste, repetitive tasks that machines can handle.

➡️ Make VC more humane.

➡️ Spend more time with founders.

➡️ Understand them deeply — without a memo looming in the back of your mind.

If you’re serious about staying ahead in this AI-native investment era, you should check it out.

We owe it to the founders to move faster, show up sharper, and focus our time on what only humans can do 💪

🏆 Ah, and Kruncher is recognized by Data-Driven VC and put right next to our fav names like ChatGPT and Perplexity.

Try Kruncher for free to see for yourself, or get a free discovery call with the team to see whether Kruncher is right fit for you.