The unicorn hunt is getting expensive, with more zonks than wins. Since 2010, the VC strategy has revolved around finding the next billion-dollar company. VCs would spray capital at promising startups, betting that one in thousand would achieve mythical unicorn status and return the entire fund.

But the global macroeconomy has mandated a different path. VC funding increased by 5% in Q2 2024 ($94B) but plummeted to $66.5 billion by Q3 2024, a painful 16% decline. Talk about a false sense of security.

More revealing than the volatility is where the money went. Late-stage funding dropped 20% year-over-year while seed deals increased by 35%. Strip out xAI's massive $6 billion round, and early-stage deal sizes actually decreased 7%.

Translation: VCs are writing smaller checks to earlier companies because they can't afford to bet big on unproven growth stories anymore.

With no clear signs of the economy correcting to previous levels pre-pandemic, many are withdrawing from bold bets and retreating back to safer choices: the horse, not the unicorn.

Unicorns vs. Horses

While VCs were hunting unicorns, profitable companies kept doing what they do best: making money.

These "horse" businesses (companies generating steady cash flow and are profitable) never disappeared. They were just meh. During the 2010s, profitability was a sign for lack of ambition and inability to scale. People want the next Uber and Airbnb style of rocketing growth and valuation, delaying profitability for the promise of huge market capture and cashing in later.

But that math only worked when unicorns were achievable and exits were predictable. Today's economic environment has broken both assumptions.

The 2020-2024 period revealed the fragility of the unicorn playbook. VCs and startups coast in the 2010 decade because interest rates had never been lower. Then, a slew of global events happened and caused the global economy to crawl slowly downwards, still to this day.

The shift accelerated through 2021's market exuberance and 2022's brutal correction. Investors started asking, when will you be profitable? Can you survive without raising more money?

Uber finally achieved profitability in 2023, twelve years after founding. For those unlucky enough to be unable to wait 12 years, the likes of WeWork imploded spectacularly. We’ve seen our fair share of billion dollar valuations plummet to nothing.

Meanwhile, boring businesses that sold software to other businesses, or manufactured things people actually needed, or provided services customers willingly paid for, kept making money throughout every market cycle.

The Economics of Patience

Traditional VC economics assumed you could lose money on 49 investments if the 50th returned the fund 100x. But this only worked when fund cycles were predictable and exit markets were reliable. When IPO markets freeze and acquisition activity stalls, even successful unicorns can't provide liquidity.

Horses solve the waiting period. They generate actual cash flow while VCs wait for their unicorns to mature. They provide steady returns that keep LPs happy during long holding periods. Most importantly, they reduce portfolio risk by creating multiple viable exit paths.

A profitable company worth $50 million today might be worth $200 million in five years. Not unicorn-scale returns, but real money that compounds over time. And if markets crash, profitable companies survive while cash-burning unicorns die.

The VC Strategy for 2025+

Smart VCs are adapting by pursuing what might be called a "barbell strategy": a few high-risk unicorn bets balanced by many profitable horse investments.

This requires different evaluation criteria. Instead of prioritizing TAM and growth potential above all else, VCs are rediscovering fundamentals: unit economics, customer satisfaction, competitive moats, and path to profitability.

It also requires different sourcing strategies. Profitable companies don't need venture capital the same way cash-burning startups do. They're harder to find, more selective about investors, and often prefer debt or revenue-based financing over equity dilution.

But they're better investments for current market conditions. They provide downside protection during economic uncertainty while maintaining upside potential during recoveries.

The truth is, economies need both unicorns and workhorses. Innovation and reliable bedrocks. For VCs, the choice isn't binary. There’s room for bold bets on potential unicorns with steady investments in proven business models. The unicorns provide venture-scale returns when they work. The horses provide cash flow and downside protection when they don't.

The 2020-2024 period taught us that market conditions change faster than fund cycles. VCs who diversified between unicorns and horses navigated uncertainty better than those who bet everything on billion-dollar outcomes.

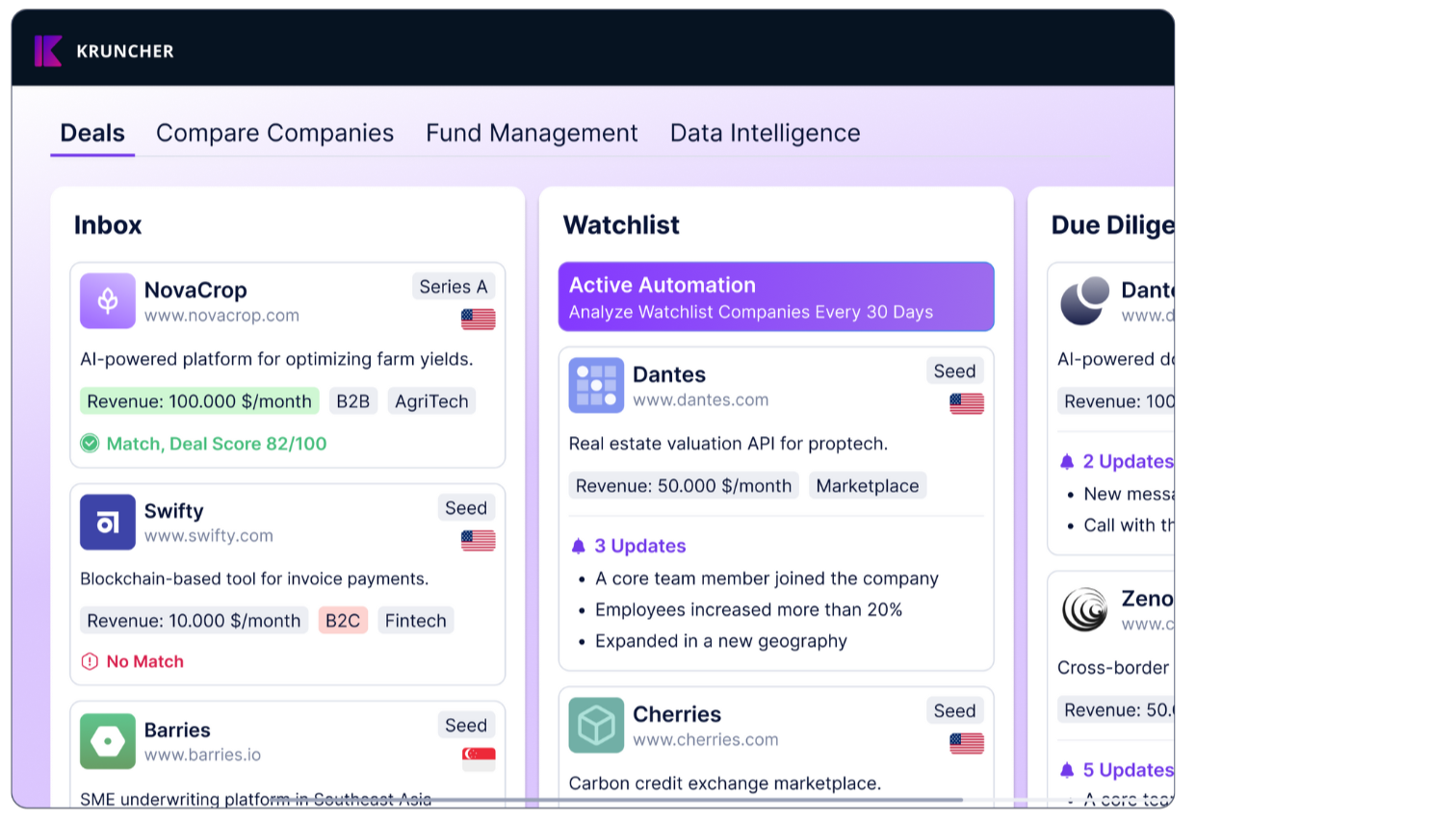

I made Kruncher to help funds systematically evaluate companies across the profitability spectrum. Set different parameters for unicorns and horses. Spot both tomorrow's unicorns and today's overlooked horses.

In venture capital, as in mythology, the most valuable treasures are often the ones you didn't know you were looking for.