I’ve worked with 20+ investment firms implementing AI systems. In that experience, I’ve noticed a consistent pattern: funds that build with specialized agents outperform those using generic AI tools by every meaningful metric, such as deal processing speed, analytical accuracy, and portfolio monitoring effectiveness.

When I first started building Kruncher, I knew it had to be AI, but it cannot be based on yet another general-use AI. As smart as LLMs are, it’s prone to many problems that would make a truly intelligent system for investors impossible.

The key is being specific. It’s remarkably similar to how we teach others. The more specific instructions, tasks, and examples we give, the better others understand us, and the better they perform.

In 2025, this specificity in using AI has a term: AI Agents, or Agentic AI.

In this post, we share what we've learned from building AI systems for venture capital and other investment use-cases and provide a technical framework for understanding why specialized agents are necessary for professional investment workflows.

Defining AI Systems for Investment

When we talk about automation systems for investment, we need to distinguish between three different approaches:

Generic AI Tools are systems like ChatGPT or Claude that apply general reasoning to any input. They're designed to be broadly capable across many domains but lack specialized knowledge or systematic processes for specific professional workflows.

AI Agents are systems trained and optimized for complex tasks. In the context of investment intelligence, it handles founder analysis, market sizing, competitive assessment, or portfolio monitoring. Each agent has dedicated data sources, analytical frameworks, and domain expertise.

Multi-Agent Systems orchestrate multiple specialized agents working together, similar to how professional investment teams operate with different experts handling different aspects of analysis, to handle even more complex tasks with thousands of steps.

The key architectural distinction: Generic tools try to do everything at 70%, while specialized agents aim to be 95% at specific tasks.

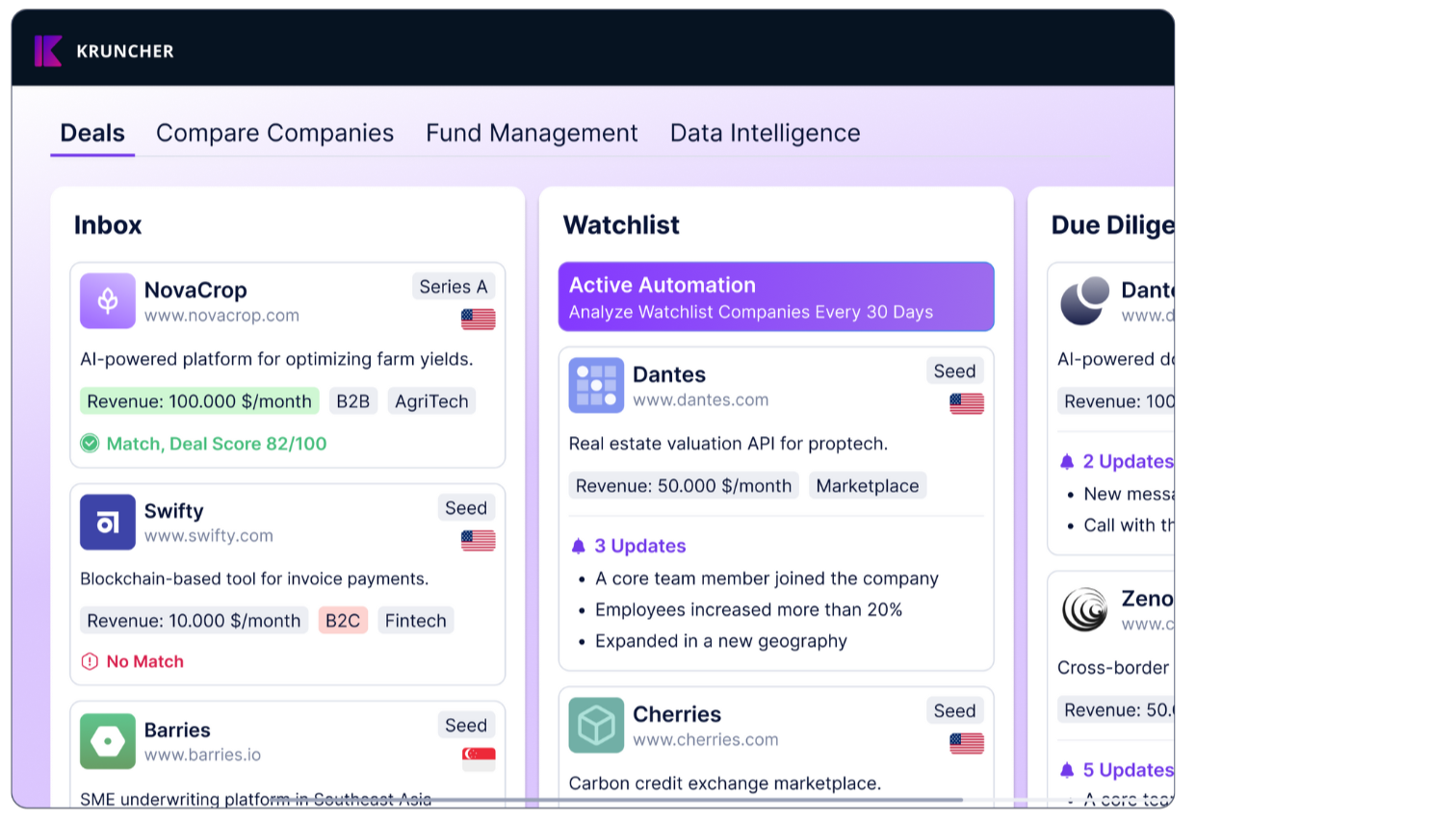

This is the key to building Kruncher. For a truly powerful and robust investment tool, generic won't be enough. It’s a multi-dimensional field and each aspect needs high quality analysis, hence our (now) collection of around 30 specialized AI Agents.

When (and When Not) to Use AI in Investment Automation

This might surprise you, but not every task requires AI. We don’t use AI for the sake of having AI in the name, but we recognize it as the next step of automated intelligence that helps humans better.

For many applications, optimizing human processes or using simple automation is sufficient. AI systems trade cost and complexity for analytical capability. You should only add this complexity when it demonstrably improves outcomes. Don’t apply AI in everything and overcomplicate your process.

-2.jpg?width=1920&height=1080&name=Heading%20(1)-2.jpg) When simple solutions work:

When simple solutions work:

- Basic document formatting and presentation tasks

- Scheduling and administrative workflows

- Simple data extraction from standardized formats

When specialized AI becomes valuable:

- Processing large volumes of inbound deals systematically

- Monitoring multiple portfolio companies simultaneously

- Conducting comprehensive competitive analysis across market segments

- Integrating data from 15+ sources for investment decisions

When multi-agent systems are necessary:

- Complex due diligence requiring multiple analytical frameworks

- Portfolio-level analysis across different company stages and business models

- Systematic pattern recognition across historical investment data

The rule: Start with the simplest solution that works, then add complexity only when needed.

Building Blocks: The Foundation of Investment AI Systems

The basic building block of effective investment AI is an LLM enhanced with investment-specific capabilities: Access to financial databases, market research, competitive intelligence, and historical investment data.

Current models can actively use these capabilities: generating targeted research queries, selecting appropriate analytical frameworks, and determining what information matters for specific investment decisions.

The team at Kruncher has spent backbreaking work to tailor our AI Agents to your fund's specific investment thesis and ensuring they provide reliable, well-documented interfaces for complex analytical tasks. That’s how we get our filtering system to actually surface relevant companies, and Kruncher Insights to deliver accurate summaries.

Another reason why we use agents is the nature of investing: Open-ended investment problems where you can't predict the required analytical steps. Agents operate for multiple cycles, requiring trust in its decision-making process.

Here are some categories of Kruncher’s AI Agents:

Portfolio Monitoring Agents:

- Continuously tracks multiple companies across different metrics

- Identifies concerning patterns and escalates appropriately

- Generates regular reports tailored to each company's stage and risks

Market Intelligence Agents:

- Monitors competitive landscapes across portfolio companies

- Identifies new market entrants or significant competitive developments

- Provides strategic recommendations for portfolio company positioning

Due Diligence Agents:

- Systematically gathers information across multiple data sources

- Adapts analytical approach based on company characteristics

- Produces comprehensive analysis while flagging areas requiring human expertise

Founder Analysis Agents:

- Processes LinkedIn profiles and Crunchbase data

- GitHub contributions

- industry publications and university networks

- Use frameworks optimized for evaluating entrepreneurial backgrounds

Financial State Agents:

- Reconciles multiple financial data sources

- Applies ratio analysis frameworks

- Identifies patterns specific to startup financial modeling

Just to name a few.

Learn more about our AI Agents here.

Learn more about our AI Agents here.

Why 30+ AI Agents?

In the case of venture capital, value comes from pattern recognition across hundreds of similar situations. This requires maintaining sophisticated databases of comparable companies, market conditions, and investment outcomes, then applying appropriate analytical frameworks.

This is a snapshot of the rigor and resources required to make an AI capable enough to perform at a level that’s finally helpful for investment professionals:

- Historical databases of investment outcomes correlated with early-stage indicators

- Comparative analysis frameworks that adjust for market conditions and company stage

- Pattern recognition algorithms trained on investment-specific success factors

- Continuous learning from new investment data and outcomes

Investment monitoring requires specialized algorithms for detecting meaningful changes across portfolio companies. This goes beyond simple metric tracking to identifying patterns that predict future performance:

- Multi-dimensional change detection across financial, competitive, and operational metrics

- Temporal analysis algorithms that understand normal variance versus concerning trends

- Anomaly detection optimized for startup growth patterns rather than general business metrics

- Escalation frameworks that understand which changes require immediate attention

The technical advantages of specialized agents over generic AI stem from fundamental differences in how they approach investment analysis.

Cognitive Load Distribution: Instead of asking one system to handle dozens of analytical frameworks simultaneously, specialized agents allow focused expertise on specific aspects of investment decisions.

Data Processing Optimization: Each agent optimizes for specific data types and analytical requirements rather than trying to handle everything adequately.

Quality Control Through Specialization: Multiple agents provide natural quality control, with disagreements flagging areas that require human judgment.

Scalable Expertise: Specialized systems can achieve world-class performance in narrow domains rather than general competence across all areas.

When Kruncher was able to finally perform at that intuitive and intelligent level that I need it to, that’s when I know that it’s truly a value-add product, and it can only get better.

“We are entering a world where we will learn to coexist with AI, not as its masters, but as its collaborators.” – Mark Zuckerberg

Closing Thoughts

Investment firms using specialized agent systems are developing sustainable advantages over those relying on generic AI tools. They process larger opportunity sets systematically, maintain more sophisticated analytical standards, and identify patterns that manual analysis would miss.

This is not a story of replacing human expertise. It's about using AI to handle the systematic analytical work that consumes enormous time while adding limited insight, freeing partners to focus on relationship building, strategic thinking, and the complex judgment calls that determine investment success.

Here’s a thought: Problems come from previous solutions that solve previous problems. Plastic was made as a solution to houseware and utensils that used to be made of wood and was causing massive deforestation. Now, we have to solve problems caused by plastic pollution in our world.

It is largely the same with AI. After it fulfils its purpose of being a solution, it will later present problems that we need to solve. It is already causing problems in the present day.

As a developer at heart, hearing problems to come only excites me. The only way forward is to build better systems, better efficiency, and do better results. AI will continuously improve, and one day something else might even replace it.

No matter how tech develops, Kruncher will always evolve and innovate to give you the best solution at the time available.

For firms ready to implement specialized agent systems, we've built Kruncher with 30+ purpose-built agents for investment workflows. Explore how this approach works in practice with our free trial, no credit card required.

Alternatively, speak to our team in a complimentary 30 minutes call to see whether Kruncher fits your needs.