More and more, the 40% rule in PMF does not apply.

For over a decade, VCs have relied on Sean Ellis's famous metric that if 40% of users would be "very disappointed" to lose your product, you've achieved product-market fit.

These metrics worked well during the 2010s, when capital was cheap, consumers were optimistic, and growth mattered above all.

But 2025 isn't 2015.

Today, the world is under a constant cloud of geopolitical instability, inflation, and capital scarcity. This is a fundamentally different environment. 2010s PMF measured growth when what matters now is resilience. They measure user sentiment when what matters is willingness to pay during economic stress.

This is what I think VCs today should think about when talking about PMF.

Why Traditional Metrics Are Failing

The well-known metrics of PMF are all mostly about growth and customer satisfaction about the product.

But 2025 and beyond will be a different world. Now, customers are pickier and looking to tighten the belt and cut costs. Counterintuitively, disappointment doesn't necessarily predict churn.

Traditional PMF metrics were also designed for a world where products took years to build and market conditions remained stable. But when AI tools enable rapid iteration and smaller teams can compete with established players, the measurement windows are too slow.

Many investors and partners say to me that they’ve never felt this overwhelmed before. The market is shifting far too rapidly for traditional, celebrated frameworks to grip. We struggle to latch on.

Real PMF in 2025?

It’s economic necessity under stress.

Measure who keeps paying when times get tough. The metric that matters: retention during customer budget cuts. Companies with true PMF see customers cutting other expenses before canceling their subscription. Slack survived the 2020 downturn because companies laid off employees before canceling communication tools.

The test:

❌ Users say they love your product

✅ Users consider it a non-negotiable must have.

To be even critical, I’d say:

❌ (Free) users use your product a lot

✅ Users pay for your product.

It’s moats over growth.

Traditional metrics favor products that grow quickly through network effects or viral mechanics. But in an environment where new competitors can launch sophisticated products using AI-assisted development, growth speed matters less than defensibility.

The test:

❌ Users leave the moment a cheaper alternative pops up

✅ Users stay even with higher pricing, due to trust placed on the brand.

Implementation for Modern VCs

These insights require different due diligence approaches and portfolio monitoring systems.

During initial evaluation, focus on crisis performance rather than growth metrics.

Ask founders: What happened to user behavior during their worst month? How did customers respond when competitors launched similar features? Which customers would still pay if prices doubled?

For portfolio monitoring, track leading indicators of economic resilience rather than lagging indicators of growth. Watch for changes in payment patterns, feature usage intensity, and customer support sentiment: These signal PMF erosion before traditional metrics show problems.

Maybe most importantly is to accept that PMF in 2025 is a moving target. It’s not a cop-out answer. In a world where competitive landscapes shift rapidly and economic conditions remain volatile, product-market fit requires continuous validation rather than one-time achievement.

The Real Test

The ultimate PMF test for 2025 isn't complicated: If your product disappeared tomorrow, would customers immediately start looking for alternatives, or would they pay whatever it takes to get it back?

At the end of the day, cash is still king.

Traditional metrics worked when markets were stable and capital was abundant. But in an era of economic uncertainty and rapid technological change, only necessity-based metrics predict which companies will survive the next downturn, and which will join the long list of startups that confuse user satisfaction with market demand.

The companies that understand this distinction will build the enduring businesses of the next decade. The ones that don't will optimize for vanity metrics while their competitors build products customers actually can't live without.

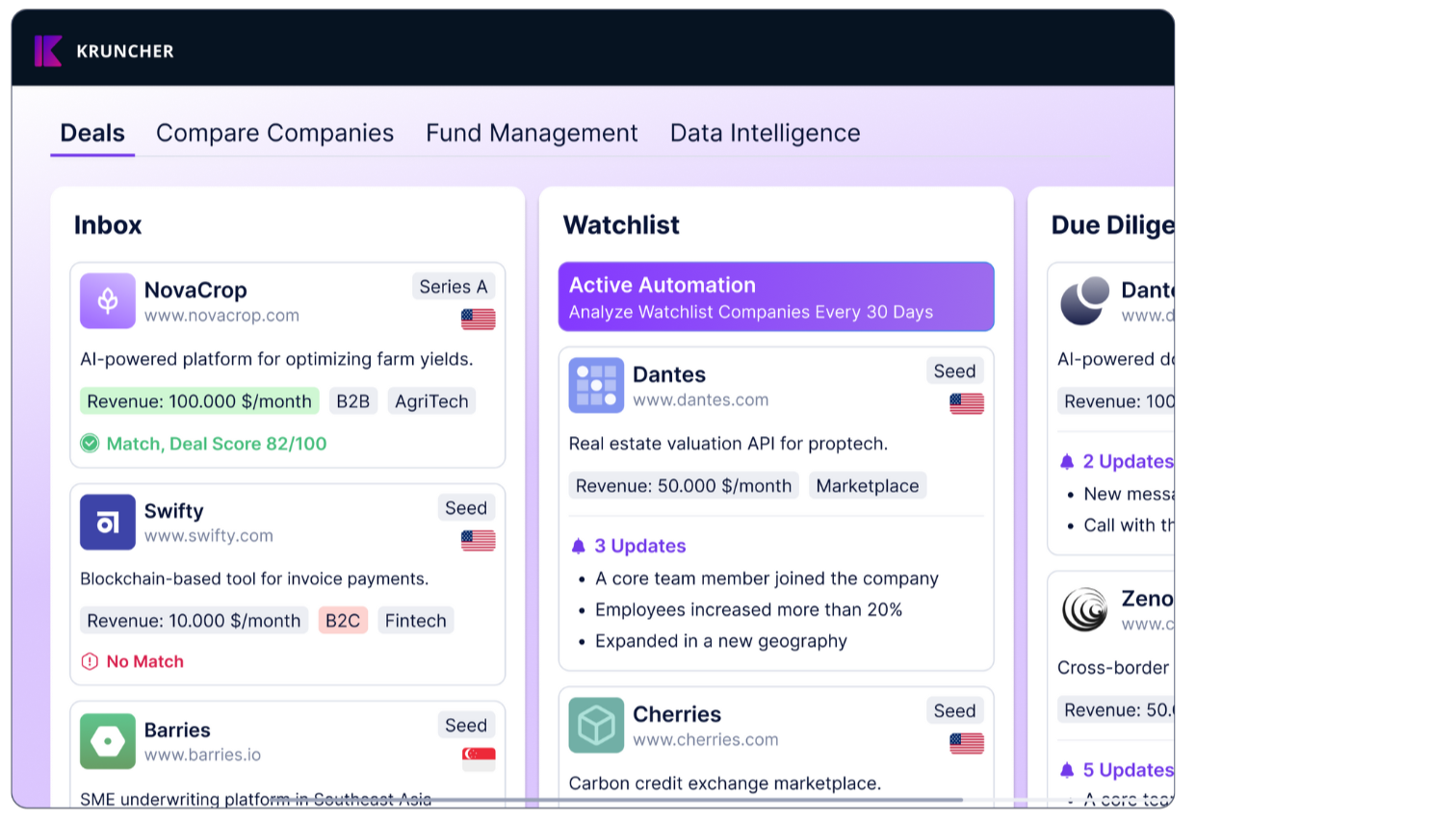

About Kruncher

Kruncher is a team of AI, financial, and technology experts united by a single mission: to transform how venture capital firms discover, evaluate, and manage investments in the AI era. As of time of writing, 20+ investment firms use Kruncher’s AI-powered platform to sharpen their deal flow, due diligence, and portfolio strategy.

For investors seeking to measure modern PMF indicators systematically, AI-powered analysis platforms like Kruncher can track these new metrics across portfolio companies, identifying early signals of economic resilience before traditional metrics show problems.