"Five hours of analyst work compressed into five minutes the crucial finding was that no quality was sacrificed. In fact, the speed was accompanied by an improvement in the quality and depth of the analysis” — Oscar Marquina, General Partner, Marvin VC

EXECUTIVE SUMMARY:

Since using Kruncher, Marvin VC has seen key improvements in:

- 60x Faster Analysis: 5 hours manual work per company, down to 5 minutes

- 100% Inbound Coverage: Every opportunity gets the same high-quality of analysis

- Focus on High-Value Work: Partners spending more time with founders instead of manual research

Who is Marvin VC?

Marvin VC operates with the McKinsey alumni network. It has produced over 100 unicorn founders and 150 Y Combinator-backed startups globally, one of the highest-performing alumni networks in technology. Yet this network remained largely untapped by dedicated venture capital until Marvin VC.

Fund Profile:

- Focus: Early-stage B2B SaaS founded by McKinsey alumni

- Geography: USA

- Deal Flow: 60+ opportunities monthly

- Investment Thesis: Investing in operators solving enterprise problems they personally experience. And supporting them by leveraging the network effects of the McKinsey Alumni network.

The Challenge

Too Much Quality Deal Flow

With 60+ inbound opportunities monthly from this network, Marvin VC's small team couldn't perform deep analysis on all of them. As a generous estimate, traditional analyst work on each deal required 5 hours for initial deep-dive analysis.

At 60 companies per month, this meant 300 hours of analyst time—about two full-time analysts working exclusively on initial screening. For an emerging fund, this is a steep expense

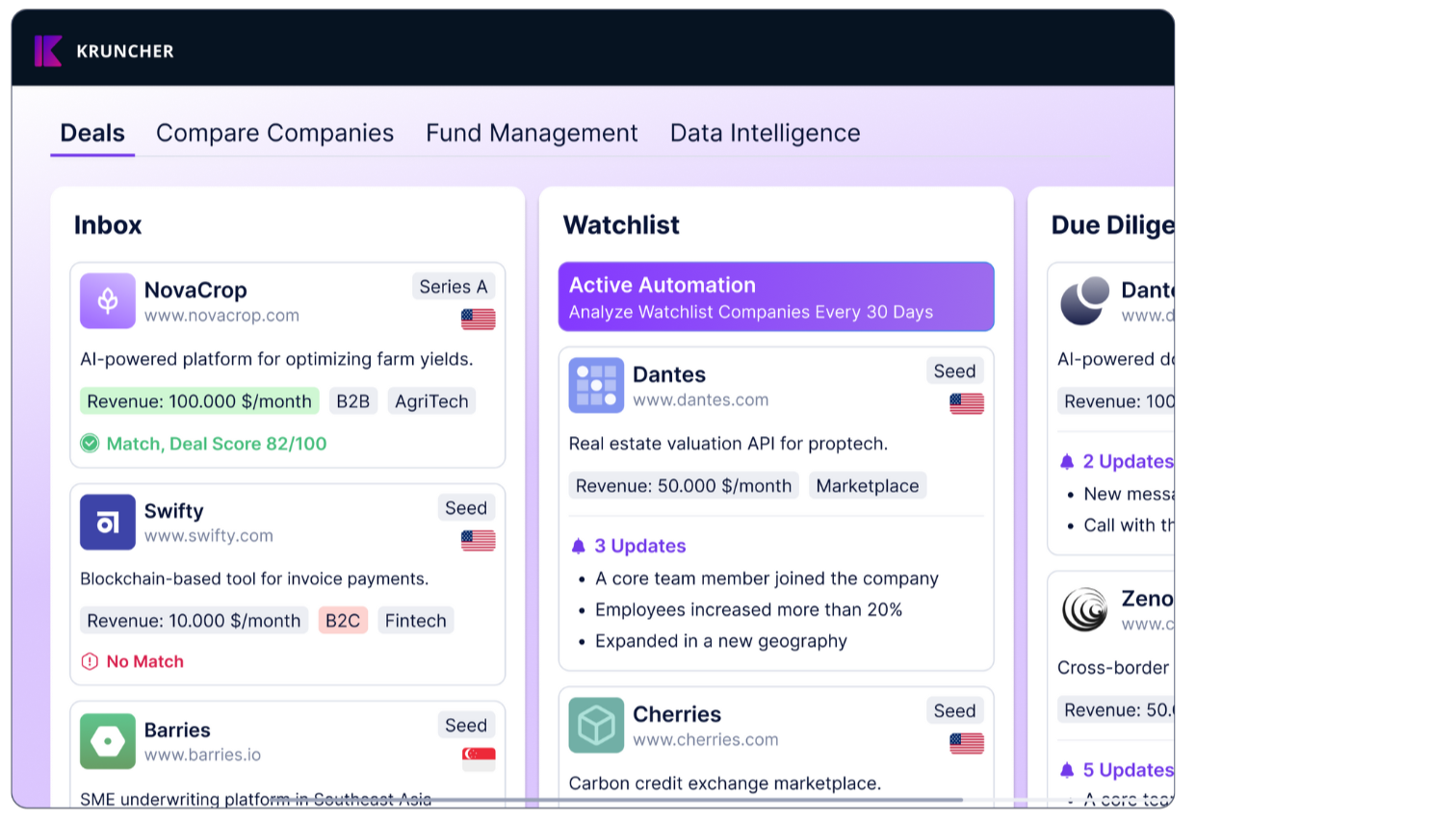

Working with Kruncher

Marvin VC discovered Kruncher while researching portfolio intelligence platforms. What differentiated Kruncher immediately was the depth and structure of its automated company reports, specifically the comprehensive analysis of founders, competitors, markets and traction that previously required hours of manual research.

For a fraction of the time, Kruncher's automated reports captured 95% of the insights their analysts had identified, while surfacing several additional data points they had missed, particularly around competitive positioning and market trajectory.

Kruncher's team worked closely with Marvin VC to customize the platform for their specific workflows, and to integrate Attio with Kruncher to ensure their CRM is always up-to-date.

"The right partner makes all the difference. Kruncher feels right and it has all the capabilities and security that [we] need. Kruncher is the right partner for us."

How Kruncher Changed Marvin VC's Investment Process

1. Deep Founders Analysis

Evaluating founder backgrounds in B2B enterprise requires understanding not just credentials, but whether the founder has the specific domain expertise, network access, and operational experience to succeed in their target market.

Kruncher's founder analysis section provides:

- The founders’ email address for outreach

- Condensed professional history with emphasis on relevant experience

- Previous venture outcomes (if applicable)

- Team composition and complementary skill sets

"The founder analysis saved us countless hours of LinkedIn stalking and reference checks. When we look at a company now, we immediately know if the founder has genuine domain expertise or if they're making a lateral leap into an unfamiliar space. That signal alone helps us prioritize which opportunities to pursue."

2. Instant Competitive Landscaping

With its innovative, proprietary algorithm, Kruncher is able to instantly retrieve a company’s competitors and gives a rationale as to why they’re considered competitors. Users can also manually add a competitor for Kruncher to add into this competitive mapping.

Kruncher's competitive analysis section provides:

- Comprehensive market mapping across direct and indirect competitors

- Competitive positioning analysis (feature comparison, pricing, target customers)

- Differentiation assessment and defensibility

- Recent competitor funding and expansion signals

This analysis helps Marvin VC quickly determine whether a company is entering a crowded, commoditized space or has identified a genuine gap in the market.

3. Automated Market Analysis

Before Kruncher, market analysis meant assembling data from multiple sources: industry reports, competitor websites, analyst coverage, and market sizing estimates. Synthesizing this into coherent market understanding took two hours minimum.

Kruncher's market analysis section provides:

- TAM/SAM/SOM sizing and CAGR with data source transparency

- Market growth trajectory and key drivers

- Regulatory and macro factors affecting the sector

- Industry trends and value chain data

The analysis does more than just presenting data. It synthesizes insights about whether the market timing is right, which segments are most attractive, and where potential headwinds exist.

4. Spot Companies with Strong Traction

Finally, see which companies are growing fast versus the rest. Kruncher’s AI agents' sources from news sites, social media, and other public sources. Kruncher can even determine a company’s customer and partnerships to understand growth or churn.

Kruncher’s Growth Indicators section provides:

- Web Traffic growth/decline & Company ad spend

- Social media numbers that indicate virality, strong interest and PMF

- The company’s list of customers and partnerships. Kruncher can track whether they’re new or churned.

Real Impact: Partner Time Redeployed to High-Value Activities

Thanks to company analysis no longer taking hours, Marvin VC partners can now fully focus on deepening real connections with founders from the best startups and their networks.

This shift has strengthened their reputation as investors who are genuinely hands-on, supportive, and adds value beyond just capital.

The benefits that Marvin VC has been getting:

- Time with founders no longer feels rushed – reducing friction and improving the relationship

- Partners can focus on deeper research and calls with customers and competitors to understand the scene better

- Human time freed for high-value, soft-skills activities. AI does the manual work.

"We built Marvin VC to be the most valuable partner for McKinsey alumni. Kruncher lets us actually deliver on that promise. We're not just faster at writing checks, we're more available, more helpful, and more strategic because we're not buried in research that AI can do better anyway."