IMPORTANT NOTE: You must already have your Investment Criteria set up in order to view Deal Scores. Read this guide on how to set up your Investment Criteria.

After assigning each company as Match or No Match, Kruncher takes it a step further by giving each company its own Deal Score.

Your deal score is a numerical rating (0-100) that appears on every company report in Kruncher. A higher Deal Score number means the company more closely matches your thesis.

As a default, every new account has a default deal scoring framework. This guide covers how you can customize the deal score framework to best match your unique investment thesis.

Where are deal scores displayed?

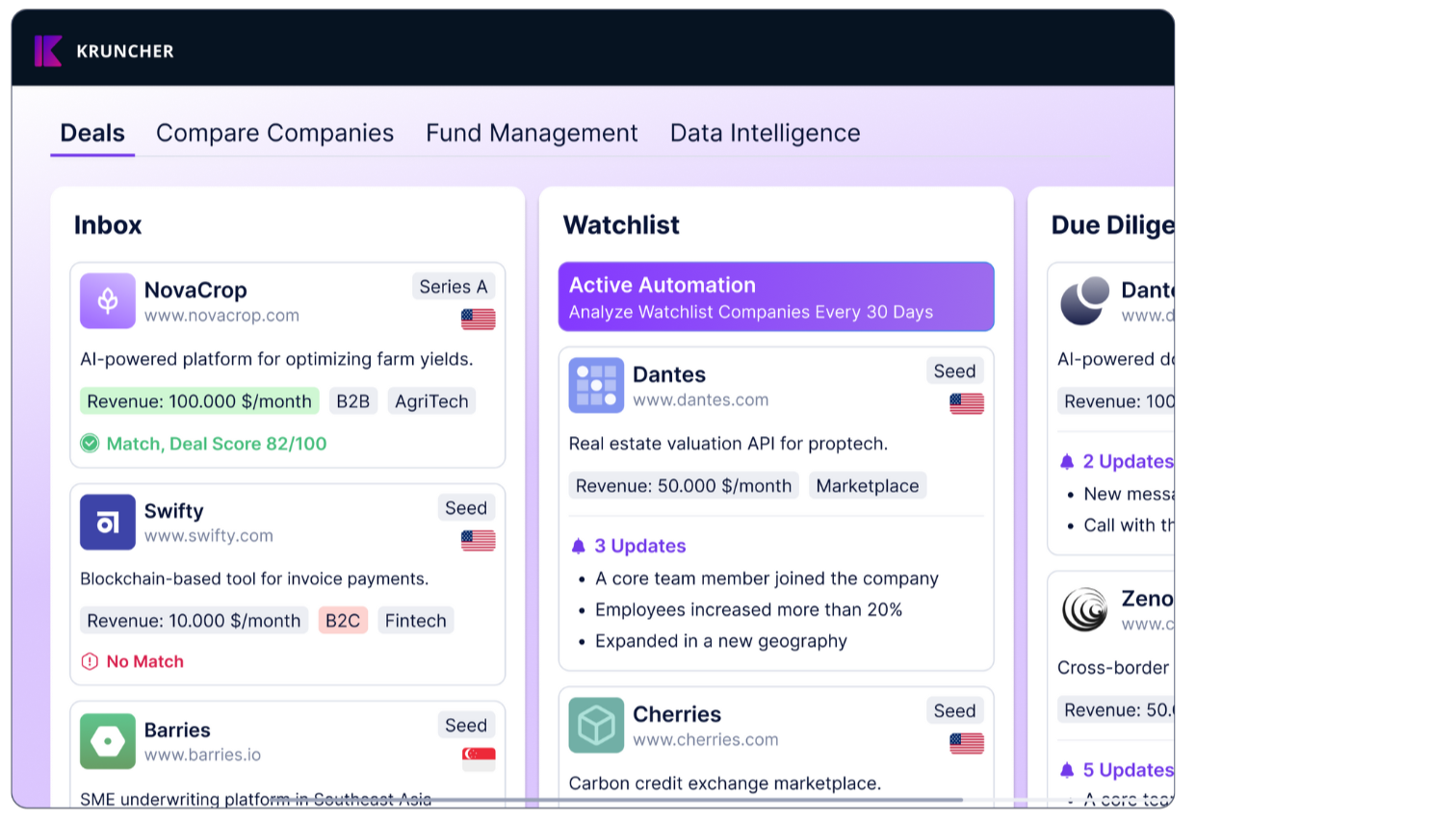

A company's deal score appears in:

In its card in your Main board (Board view), right next to its Match label.

In the Deal Score column in your Main board (Table view). You might need to scroll to the right to see it.

Inside its Company Report, on the Deal Score card.

NOTE: Only Match companies will have their deal scores displayed by default.

How to customize your deal score framework

1. Settings → Deal Score Framework

Click Settings (⚙️) on the top left, and go to the Deal Score Framework tab on the left.

Here, you can customize what metrics define each factor of the deal score, what are their weightages, and set dealbreakers.

As a default, every new account has a default deal scoring framework already preset.

NOTE: If your deal score framework sections are empty, simply click + Add Metric.

2. Create New Metrics

You can create new metrics for that section by clicking + Add Metric.

A pop-up will appear, and you can select a metric from a dropdown menu. Here, the logic is very similar to using simple Excel formulas.

Metric: For example, in the Team section, select Solo Founder as the metric you want to add.

Operator: Choose < or > for numerical metrics (e.g. Number of Customers), = for Yes/No metrics (Founder with Sales Experience).

Value: Determined by your operator. Selecting < or > will allow you to input a numerical value in this field. Selecting a = as the operator makes this field a choice of either True or False.

Result: Outstanding, Good, or Dealbreaker. Choose how this metric affects your deal score.

Click Confirm when you are done setting up your new metric.

Repeat this step as you deem necessary.

NOTE: Kruncher has over 120 metrics to choose from to shape your deal score framework.

Have suggestions about metrics to be added into Kruncher? Send us an email to info@kruncher.ai

Don't see a metric you want as an option? Customization is available to our enterprise customers. Contact our sales team for more details.

3. Example Metrics

Example 1: Solo Founder = True, Dealbreaker.

Meaning: If a company is helmed by a solo founder, then Kruncher will define this company as a dealbreaker.

Example 2: Customer Growth in 12 Months > 200, Outstanding.

Meaning: If this company’s customer growth is more than 200 in 12 months, then Kruncher defines this company as outstanding

4. Customize Weights

Click on the section's title weights (edit).

A pop-up will appear for you to customize the weights of each section.

The default weight is set at 20% equally for each section.

NOTE: Weights must be 100% in total.

Understanding how Kruncher calculates your deal score

1. Definition of Outstanding, Good, and Dealbreaker

Inside each section, you will evaluate the startup based on specific “Metric” you set (e.g., for Team: Founder with Exit Experience, Top University Alumni, etc.)

Your deal score is a numerical rating (0-100) for each company.

Kruncher takes a unique approach in normalizing the score by starting each section with a score of 50% out of 100%, for a total of 50 points for the entire deal score.

Your metrics then modifies the score to be higher or lower. If a company meets an Outstanding metric, Kruncher assigns it +3 points. Good metrics award +1 point.

When there are more than 2 Outstanding ratings within a single section, Kruncher applies a progressive bonus to reward exceptional strength. For example, 2 Outstandings in one section will give +7 points instead of +6.

There are no modes that can deduct points other than Dealbreakers. Dealbreaker metrics work differently by setting the score of that entire section to 0 if there is one, regardless of other Outstandings and Goods in that section.

This effectively nulls the 50% default score given for that section.

In summary,

| Outstanding | +3 points |

| Good | + 1 point |

| Dealbreaker | Automatically scores entire section to 0 |

2. Understanding Weights

After Kruncher calculates each section's score from its metrics, it runs through the numbers through a weightage system.

You can prioritize certain sections over the others by making the weight of that section bigger, and vice versa to de-prioritize that section, reduce its weight.

Here are some suggested weight distribution based on common fund focuses:

| Area | Early-Stage Focus | Growth/Late-Stage Focus |

| Portfolio Fit | 20% | 10% |

| Team | 30% | 20% |

| Traction | 10% | 30% |

| Market | 25% | 30% |

| Business Model | 15% | 10% |

3. How Kruncher Calculates the Deal Score

First, Kruncher calculates the maximum possible score for each section by summing all points available when a company achieves all Outstanding and Good metrics, then normalizes this total against the baseline 50% of the points.

In this example, the Traction section has a maximum possible score of 19 points when a company satisfies all criteria.

Maximum calculation: 19 points = 6 Outstanding metrics (each worth +3 points) + 1 Good metric (worth +1 point).

Dealbreaker metrics are excluded from the maximum total.

If awarded points exceed the theoretical maximum due to progressive bonuses from multiple Outstanding achievements within one section, Kruncher applies a ceiling to prevent scores above 100%.

Next, each thesis criterion receives its individual score.

Kruncher calculates the deal score using this formula:

([Actual points earned] / [Maximum points possible] + 0.5) * section weight * 100 * dealbreaker multiplier

Where the dealbreaker multiplier equals 0 if any dealbreaker criteria are met, otherwise equals 1.

Example Calculation

Assume a company achieves 2 Outstanding metrics and 1 Good metric in the Traction section weighted at 20%.

Points earned: 2 Outstanding metrics + 1 Good metric = 3 + 3 + 1 (progressive bonus) + 1 = 8 points

Formula application:

(8/19 + 0.5) * 20% * 100 * 1 = 18.42 points

Kruncher rounds down any decimal below 0.5, so the Traction section contributes 18 points to the overall deal score.

With dealbreaker present:

(8/19 + 0.5) * 20% * 100 * 0 = 0 points

This nullifies the default 10 baseline points allocated to that section.

Kruncher repeats this calculation for every section, then aggregates all section scores to produce a final score out of 100.

Next Steps

Next, learn how to understand Company Reports that Kruncher automatically generates for you.