While we wait for YCombinator’s Fall batch, we worked through their Winter 2025 batch of 166 startups to spot interesting trends.

There are many interesting categories in this Winter batch, so this will be a series of articles exploring the startups from the latest YCombinator batches.

For our first go, 6 startups stood out as being a Cursor with very specific applications:

- Cedar: Cursor for B2B copilot frameworks

- Onlook: Cursor for visual React development

- Orchids: Cursor for website creation

- Rebolt: Cursor for business workflow automation

- ThirdLayer: Cursor for browser-based productivity

- Wildcard: Cursor for engineering task automation

Here are the facts of each company that we can consolidate, using Kruncher’s auto-generated reports:

1. Cedar (cedarcopilot.com)

Cedar is founded in San Francisco in 2025.

What does it do?

- Cedar offers open-source AI copilot SDK for B2B developers, enabling voice, human-in-the-loop, and real-time analytics beyond a chatbot.

Who are the founders?

- Founded by Jesse Li (ex-Intuit, serial entrepreneur) and Isabelle Ilyia (ex-Figma, Notion, LinkedIn), both Georgia Tech CS graduates with deep expertise in AI, React, and software engineering.

What’s the market looking like?

- Cedar competes in the $41B global cloud-native applications market and a great 23.9% CAGR, with direct competitors like LangChain, Dust, CrewAI, OpenPipe, Superagent, and Helicone, differentiating through its open-source React framework for customizable AI-native apps.

What’s their business model and GTM?

- Cedar uses a scalable B2B SaaS and open-source model, monetizing via paid enhancements and enterprise subscriptions for AI-native app frameworks.

Is the traction good?

- Cedar Copilot has achieved early-stage PMF with multiple production deployments and has never had a customer request a refund.

2. Onlook (onlook.com)

Onlook is founded in San Francisco in 2024.

What does it do?

- AI-powered SaaS visual editor lets designers build React websites directly, bridging design-to-code gap for non-engineers.

Who are the founders?

- Founded by Daniel Farrell (ex-DIMO, Bird, Defy Marketing) and Kiet Ho (ex-Amazon, ServiceNow), the duo combines deep product design, branding, and software engineering expertise.

What’s the market looking like?

- Onlook competes in the $3.58B global no-code website builder tools market with a decent 7.73% CAGR, facing direct competitors like Bolt.new, Lovable, V0, Replit Agent, Figma, and Webflow, and differentiates through its open-source, AI-powered visual code editor for React with strong community traction.

What’s their business model and GTM strategy?

- Onlook uses a scalable SaaS subscription model, generating revenue from monthly fees for Pro and Enterprise plans.

Is the traction good?

- Onlook has grown its open-source community to over 22,265 users and contributors, achieved 22,000+ GitHub stars, and secured partnerships with vendors like Supabase and Dropbox Ventures, with organic web traffic increasing by 275% in the last month.

3. Orchids (orchids.app)

Orchids is founded in San Francisco in 2024.

What does it do?

- Orchids offers an AI SaaS platform for non-technical users to instantly create websites from prompts, solving slow web development.

Who are the founders?

- Orchids was founded by technical co-founders Bach Tran (ex-Addepar, UPenn Computer Science) and Kevin Lu (ex-AWS, Stanford HAI).

What’s the market looking like?

- Orchids competes in the $31.5B global AI-powered website builder market against Wix, Framer, Squarespace, Webflow, and Typedream, differentiating with instant AI-driven site creation from prompts and claiming 3x better performance in internal benchmarks.

What’s their business model and GTM strategy?

- Orchids uses a scalable SaaS subscription model, generating recurring revenue from online payments by individuals and small businesses.

Is the traction good?

- Orchids grew its employee count from 1 to 5 in three months, increased organic web traffic from 1,700 to 2,500 in one month (a 47% MoM increase), and closed a $2M seed round backed by Y Combinator, BoxGroup, and others.

4. Rebolt (rebolt.ai)

Rebolt is founded in San Francisco in 2025.

What does it do?

- Rebolt offers a SaaS platform enabling non-technical business users to automate workflows by chatting with AI, integrating company tools.

Who are the founders?

- Founded by Celia Manzano (ex-Salesforce), Manuel Ángel Suárez Álvarez (ex-StackAI, 3 YOE+ in AI/ML Engineering), and Javier Sánchez (ex-StackAI, ex-Canonical).

What’s the market looking like?

- Rebolt competes in the $159B global enterprise AI workflow automation market, facing direct competition from Zapier, Make, Relay.app, Levity, and integrations with Slack, Outlook, and Gmail, differentiating through AI-powered no-code app creation and deep enterprise integrations.

What’s their business model and GTM strategy?

- Rebolt generates scalable SaaS revenue via subscription and usage-based pricing, monetizing through recurring fees from enterprise and team customers.

Is the traction good?

- Rebolt onboarded over 1,000 users and enabled the creation of 1,000+ apps in a single week post-launch, with active partnerships for integrations and steady web/social growth since March 2025.

5. ThirdLayer (thirdlayer.inc)

ThirdLayer is founded in San Francisco in 2025.

What does it do?

- ThirdLayer offers an AI browser copilot SaaS that automates workflows for tech professionals, reducing context switching and friction.

Who are the founders?

- Founded by Regina Lin (ex-investment analyst, Harvard Math & CSE MS, serial entrepreneur) and Kevin Gu (Harvard Math & Statistics, ex-IBM ML researcher, Meta software engineer, Jump Trading quant researcher).

What’s the market looking like?

- ThirdLayer competes in the fast-growing $6.5B AI-powered productivity software market with an exciting 30% CAGR, facing direct competitors like Rewind AI, Adept AI, Arc Browser, Perplexity, and Microsoft Copilot. It differentiates through its proprietary Dex context engine, multi-agent orchestration, and academic partnerships, targeting early adopters and professionals in tech, finance, and research.

What’s their business model and GTM?

- ThirdLayer uses a scalable SaaS subscription model, monetizing via recurring fees for its AI browser copilot targeting professionals.

Is the traction good?

- ThirdLayer launched Dex in beta in 2025, onboarded thousands of users to its waitlist, achieved measurable user impact with active beta users reportedly saving 8+ hours a day, and formed partnerships with top research institutions like MIT, Stanford, and DeepMind.

6. Wildcard (wild-card.ai)

Wildcard is founded in San Francisco in 2025.

What does it do?

- Wildcard automates routine engineering tasks using AI agents, delivered as a SaaS platform for software teams (the users). Main features include automation of bugs, migrations, and test fixes, with integration into developer tools like GitHub and Jira.

Who are the founders?

- Wildcard was founded by Kaushik Mahorker, ex-Scale AI and AWS engineer with deep AI and software expertise, and Yagnya Patel, a former Amazon and Tesla engineer with experience in AI, software development, and computational neuroscience.

What’s the market looking like?

- Wildcard operates in the $93B global agentic AI market (projected 2032) and an exciting 44.6% CAGR, competing with direct rivals like Sweep, Linear, GitHub Copilot, and Atlassian/Jira Automation, and differentiates through deep integrations, enterprise security, and parallel AI agent automation for engineering teams.

What’s their business model and GTM strategy?

- Wildcard operates a scalable B2B SaaS model, monetizing through subscription or usage-based fees for AI automation tools.

Is the traction good?

- Wildcard launched in 2025, secured Rootly as a paying enterprise customer, reached 1,253 LinkedIn followers, and demonstrated early traction with live product usage and a reported 60% reduction in maintenance overhead for teams.

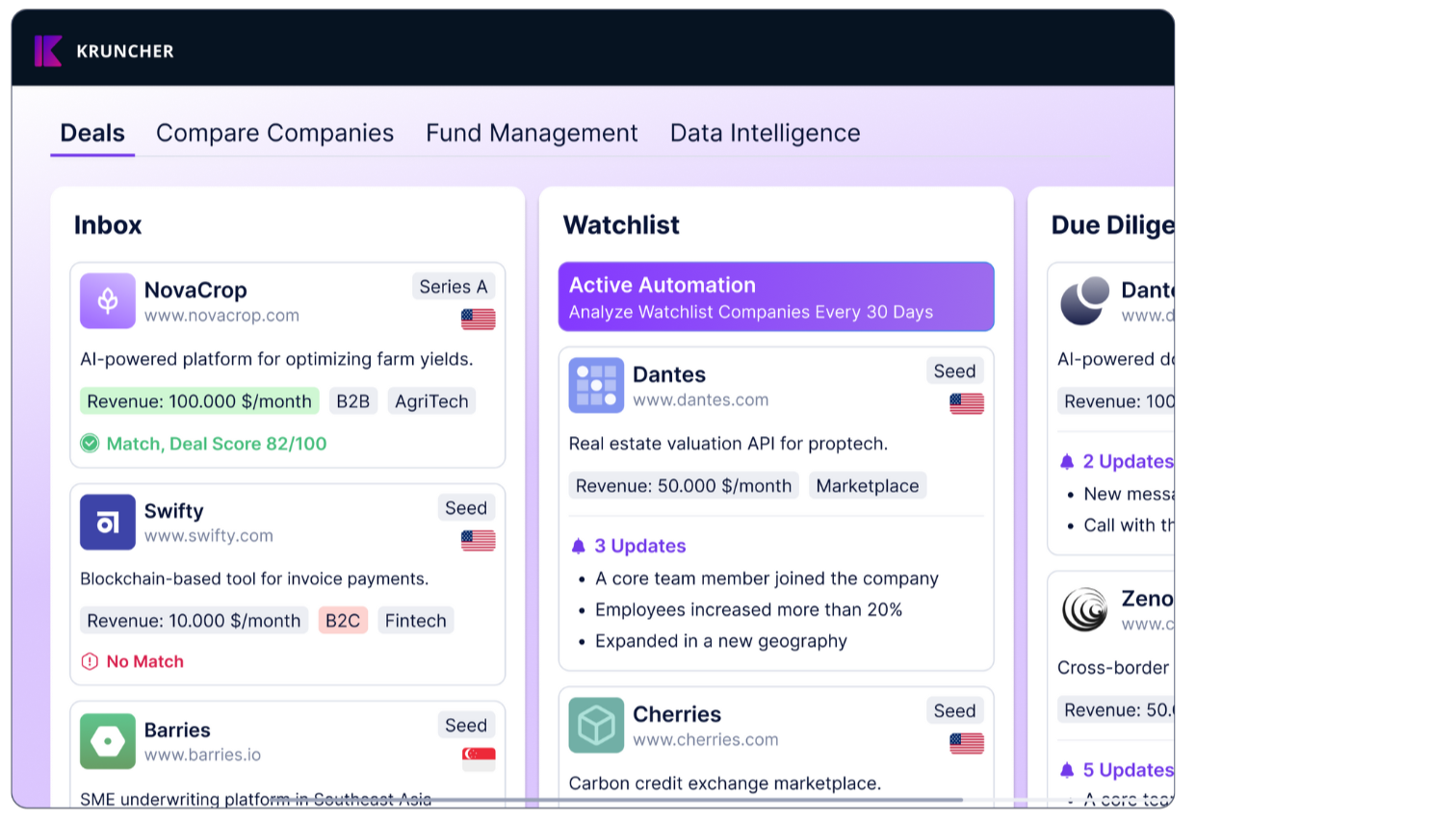

These data points were consolidated using Kruncher's AI-powered private market analyst, which automatically processes public data, funding rounds, and market intelligence to consolidate multiple information sources into one holistic view, making Kruncher the single source of truth for any company you’d like data and insights on.

If there are inaccuracies in this article, please send an email to danny@kruncher.ai

Try Kruncher for free to see for yourself.