Venture capital is fast-paced and relationship-driven. From sourcing deals to evaluating startups, managing LPs to tracking portfolio performance—every minute matters. The challenge? Keeping everything streamlined and making data-driven decisions without getting lost in spreadsheets, emails, or pitch decks.

Fortunately, new technologies are transforming how venture capital firms operate. From powerful VC CRMs like Affinity and Carta, to emerging AI-powered platforms like Kruncher, investors now have more tools than ever to optimize their workflows and stay ahead of the curve.

Let’s explore how you can make your venture capital workflow smarter, faster, and more scalable.

Why Workflow Efficiency Matters in Venture Capital

Unlike traditional finance, venture capital is about speed and precision in a noisy market. You’re handling:

- Hundreds of startup pitches

- Dozens of ongoing deals

- Continuous LP communication

- Portfolio monitoring

- Internal data analysis and reporting

Without a robust system in place, things slip through the cracks. Having the right infrastructure helps you:

- Improve decision speed

- Enhance collaboration across your team

- Strengthen founder and LP relationship

- Gain an edge in identifying winners early

Tools That Power Efficient VC Workflows

1. CRM for Venture Capital

CRMs are no longer just for sales teams—they’re at the core of the modern VC stack. A great VC CRM centralizes your deal flow, keeps track of communication with founders and co-investors, and helps you identify warm intros and patterns across networks.

Top CRM platforms for VCs include:

-

Affinity CRM – Purpose-built for venture capital firms, Affinity automatically tracks emails and calendar activity, making relationship intelligence seamless.

-

Carta CRM – Carta goes beyond cap table management and offers CRM features tailored for investors who want a unified view of portfolio companies.

-

Pipedrive or HubSpot (with VC customizations) – While originally for sales, many VCs customize these tools to fit their pipeline needs.

The best CRM for venture capital depends on your firm’s size and workflow complexity. But regardless of the tool, having a CRM is table stakes.

2. Collaboration and Workflow Tools

Beyond CRMs, modern VCs leverage tools like:

-

Notion or Airtable – For building internal investment playbooks, deal dashboards, or portfolio trackers.

-

Zapier or Make – For automating tasks like sending founder follow-ups or syncing CRM data to Slack.

-

DocSend – For securely sharing and tracking pitch decks.

These tools allow your team to move fast, work from a single source of truth, and reduce manual work.

Where Kruncher Comes In: Your AI Virtual Analyst

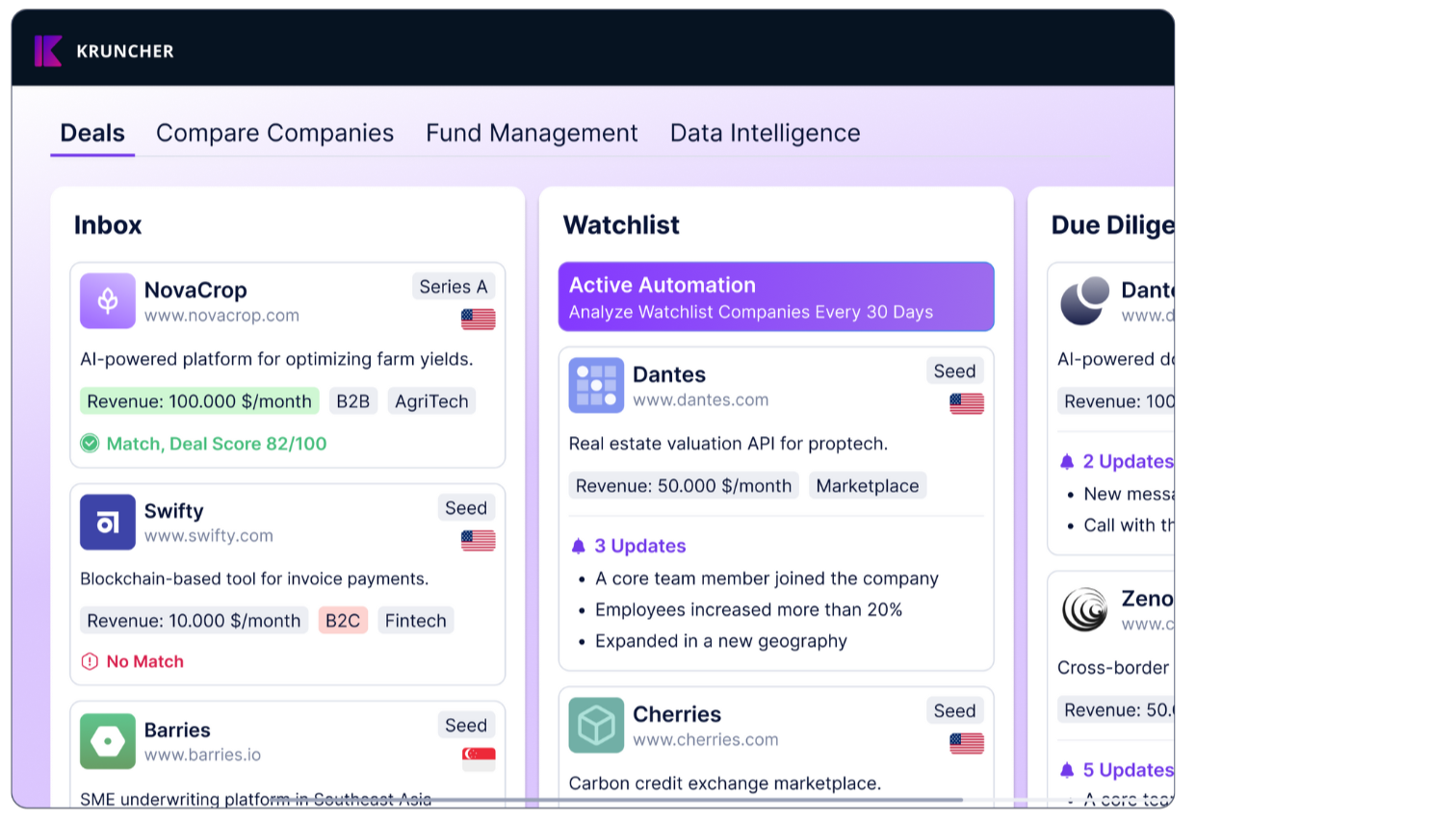

While traditional tools help you track deals, Kruncher helps you analyze them.

Think of Kruncher as your AI virtual analyst, seamlessly integrated into your existing tools (email, CRM, etc.), designed to do the heavy lifting in evaluating startups.

Enriched Company Analysis — Instantly

Kruncher goes beyond pitch decks and self-reported data by giving you a holistic, real-time view of startups through:

- Website traffic analysis – Understand growth trajectory and public interest trend

- Hiring behavior – Track job postings to gauge expansion and team development

- Competitor benchmarking – Compare startups against market incumbents and emerging players

- Founder background & achievement analysis – Evaluate the founder's track record, prior entrepreneurial success, industry expertise, and any notable achievements that could impact the startup’s potential

Integrates with Email and CRM

Kruncher connects directly to your VC CRM and email systems (like Gmail or Outlook), ensuring that deal information is captured without extra work. You can:

- Retrieve documents and company details from past email threads

- Automatically enrich CRM entries with updated startup data

- Track your engagement history and founder interactions

Automate Investment Memo Creation

Instead of writing investment memos from scratch, Kruncher uses natural language processing and company intelligence to auto-generate memos. These include:

- Business summaries

- Risk assessments

- Market opportunity snapshots

- Competitive positioning

You can edit and finalize them directly—saving hours each week.

Send Decision Emails with One Click

Once you've made a decision, Kruncher lets you easily generate and send decision emails—whether it’s a yes or a pass—without switching tabs or writing from scratch. It keeps your process human, but saves time.

Why VCs Are Turning to AI Virtual Analysts

The real advantage in venture capital isn’t just having more data—it’s being able to process and act on that data faster than others.

Kruncher enables firms to:- Increase throughput without hiring additional analysts

- Reduce bias by basing decisions on enriched, objective data

- Collaborate better, with data that’s instantly shareable across your team

Final Thoughts

In today’s venture landscape, efficiency and intelligence are everything. From using a venture capital CRM to adopting AI virtual analysts, the tools you choose can determine how fast—and how well—you invest.

Kruncher doesn’t just fit into your workflow. It upgrades it. It’s not about replacing your team—it’s about giving them superpowers.

Ready to streamline your VC process and make sharper, faster decisions?

Learn how Kruncher can integrate with your workflow