Every VC partner knows this scenario: It's 8 PM on a Tuesday, and tomorrow morning you have a partnership meeting where you need to provide an update on that promising SaaS company you led an investment in 14 months ago.

You frantically scan your inbox, trying to piece together fragments of information from scattered emails. You check LinkedIn to see if there've been any notable team changes. You Google the company name plus "news" to catch anything you might have missed. Crossing your fingers that nothing significant has happened that your founder forgot to mention.

After everything is said and done, you rinse and repeat this exhausting process at least 50 times because you don't just have 1 company to keep track of. Most partners have around 15-20, with some being saddled to handle over 50 (that’s for another story).

This is the reality of portfolio monitoring at most venture firms today: Reactive, incomplete, and fundamentally broken.

As a solution, most of you already have some CRM in place to keep track of your portfolio companies.

But you still need to spend time manually sourcing out the last updates of that company. And you and I both know only the mega funds have the resources to have a dedicated team sourcing and seeking out information.

For the rest, you just have to buckle up for another all-nighter, as usual.

In 2025, this does not have to be the case anymore. The days of 60-80 hour weeks being necessary needs to be over. Burnout benefits nobody.

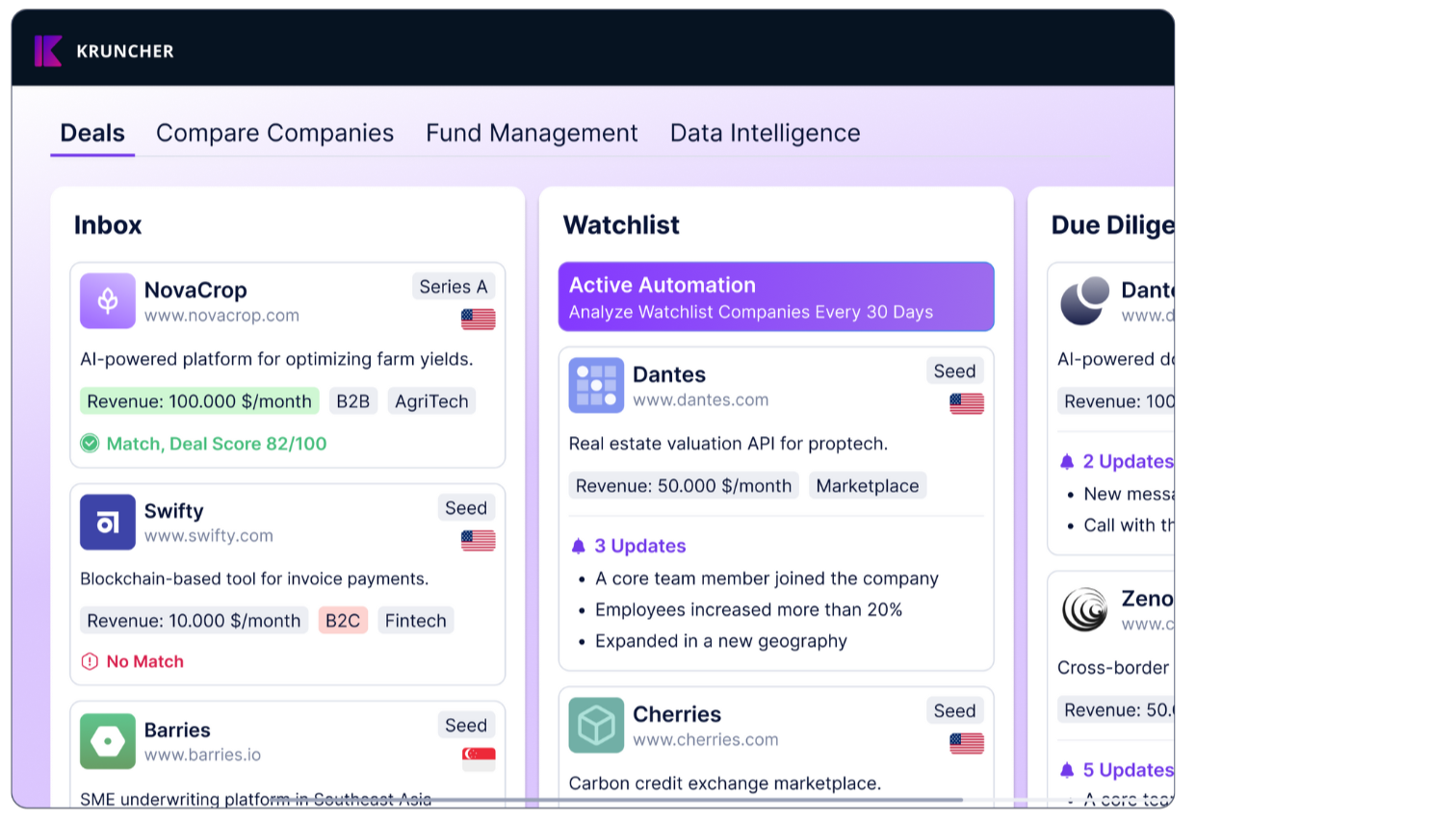

Stay with me as I highlight how Kruncher can make your portfolio monitoring process 10x easier, so you can finally clock out at 5pm. Let's work smarter.

First, Kruncher isn't just another CRM with a fancy coat of paint

I've tested A LOT of "revolutionary" portfolio management tools on the market. They all promised automation but ultimately required just as much manual work as the systems they replaced. So I understand the skepticism for Kruncher.

I've tested A LOT of "revolutionary" portfolio management tools on the market. They all promised automation but ultimately required just as much manual work as the systems they replaced. So I understand the skepticism for Kruncher.

What sets Kruncher apart is our fundamental approach to data acquisition. While other systems wait for you to feed them information, Kruncher automatically gathers it from multiple sources.

The core innovation is Kruncher's multi-source data engine. It connects to specialized APIs across the internet, scanning various different sources for different signals. All of this happens continuously and without any action required from you.

We tackle the most painful part in every other portfolio tracking system: the manual input problem. No matter how elegant the dashboard, a system that requires manual updates will eventually be abandoned when you're exhausted after a long day and have no more bandwidth left to update it.

One partner put it perfectly: "It really feels like I have an assistant watching my portfolio 24/7 and making my life actually easier, rather than another tool I need to sink my time and energy on."

How Kruncher works

Kruncher creates an intelligence network across your entire portfolio by connecting to the digital markers that indicate meaningful change. Unlike general business intelligence tools adapted for VC use, Kruncher was purpose-built for tracking early and growth-stage companies.

Kruncher creates an intelligence network across your entire portfolio by connecting to the digital markers that indicate meaningful change. Unlike general business intelligence tools adapted for VC use, Kruncher was purpose-built for tracking early and growth-stage companies.

This is the secret to our substantial and relevant insights. The system monitors specific signals that indicate company evolution, and crucially, each signal is weighted according to its relevance for your specific investment thesis and company stage.

Kruncher adapts its monitoring priorities based on company stage. For example, for seed-stage companies, it emphasized team growth and product milestone signals. For Series B companies, it prioritized revenue indicators and competitive positioning changes.

Version-Controlled Company Profiles

As a partner, I love seeing the growth of my portfolio companies over-time. So I knew I had to bring in version-controlled company profiles. You can see a complete timeline of every significant change in your portfolio companies, and compare old versions to recent ones.

As a partner, I love seeing the growth of my portfolio companies over-time. So I knew I had to bring in version-controlled company profiles. You can see a complete timeline of every significant change in your portfolio companies, and compare old versions to recent ones.

This historical tracking has saved me countless times in partner meetings. I can just pull up the exact timeline where something changes rather than relying on memory or scrambling through old emails.

For Sleepify shown above, I can immediately see that they've expanded their engineering team, launched three new enterprise features, and refined their pricing page messaging twice in the last month. More importantly, I can trace these changes back to my initial investment to understand their evolution trajectory.

The best part: All of this happens without a single request to the founder. I hate those. Even though it’s my right to be updated, I still feel I am just nagging them. Kruncher keeps your relationships with them as frictionless as possible.

Intelligent Signal Detection

One of Kruncher's most valuable features enables you to focus on the important bits and ignore the noise. The system distinguishes between routine updates and developments that warrant your attention. We call it intelligent signal prioritization.

When a portfolio company adds a new VP of Sales after struggling with go-to-market execution, that triggers an immediate alert. When they publish another standard blog post, the information is captured but does not interrupt your day.

This intelligent filtering is what differentiates Kruncher from the rest. The signals are ranked based on:

- Relevance to company stage and investment thesis

- Deviation from established patterns

- Correlation with success/risk factors for similar companies

- Historical actions you've taken on similar alerts

Over time, the system learns which signals you find most valuable, creating a personalized intelligence feed that becomes increasingly accurate.

Contextual and Actionable Insights

As an extension to intelligent signal prioritization, we also have Kruncher Insights, where AI helps you understand the significance of those changes through our proprietary algorithm that understands historical patterns and comparative analysis.

As an extension to intelligent signal prioritization, we also have Kruncher Insights, where AI helps you understand the significance of those changes through our proprietary algorithm that understands historical patterns and comparative analysis.

For Sleepify shown above, Kruncher Insights identifies specific patterns about the company’s revenue streams and whether it’s solving a painful enough problem and offering real value.

We’ve painstakingly developed sophisticated algorithms to make those insights happen, and it really performs like an experienced PA giving you the important highlights.

From this, Kruncher’s contextual intelligence can even transform raw data points into actionable insights that guide your next conversation with the founder.

From this, Kruncher’s contextual intelligence can even transform raw data points into actionable insights that guide your next conversation with the founder.

10x Convenience with Meeting Integration

By simply adding recording@kruncher.ai to your Zoom, Teams, or Google Meet calls with founders, the system automatically transcribes and analyzes the conversation. These transcriptions become part of the company's permanent record in your Kruncher account, creating an institutional memory that persists even as team members change.

When an associate who's been working closely with a portfolio company leaves, their contextual understanding of nuanced founder discussions typically leaves with them. With Kruncher, that knowledge remains accessible to the entire firm.

When a founder mentions they're considering an enterprise expansion during a call, Kruncher links that information to subsequent website changes, hiring patterns, and product updates that validate that strategic shift, giving you a complete picture of how ideas evolve into execution.

Kruncher: Allowing you to be the #1 Partner with 10x less work

I want to be candid. There's a widening intelligence gap between the largest funds and everyone else.

The mega-funds have quietly built sophisticated portfolio intelligence operations with dedicated teams of 5-10 analysts and annual budgets exceeding $1M. These proprietary systems give them comprehensive visibility across their portfolios, creating an information advantage in everything from follow-on decisions to value-add timing.

Meanwhile, most sub-$300M funds are scrambling together systems from generic CRMs, quarterly updates, and whatever partners happen to notice between meetings. Inevitably, partners get tired after a long day of work and information slips through the cracks.

This information asymmetry is becoming increasingly unacceptable as competition for the best deals intensifies.

Kruncher empowers smaller and mid-sized firms with the same (or even better!) visibility as the mega-funds but at a fraction of the cost for what most funds would spend tens of thousands of dollars for analysts wages and in-house tech departments.

Several firms have transformed their LP communications from periodic, high-level updates to data-rich, specific discussions about portfolio developments, simply because they now have the comprehensive intelligence at their fingertips.

The reality of modern venture is clear: capital is commoditized and networks are increasingly accessible through platforms. The sustainable edge now comes from superior intelligence that enables partners to deploy their scarcest resource–time and attention–with surgical precision exactly when it matters most.

Test Kruncher for free with your five most challenging companies

I understand the skepticism. You've been burned by tools that created more work than they eliminated.

So here's my straightforward proposition: Select five of your most challenging portfolio companies, the ones where you feel you don't have clear visibility, or where you suspect important developments are happening beneath the surface.

Enter them into Kruncher and watch what happens. No integration work, no complex setup, no manual data entry. Get insights immediately.

Within two weeks, you'll have at least three significant insights about these companies that you didn't previously know, that would have taken hours of manual work to uncover.

We're offering new users free analysis of their first five portfolio companies with no obligation to continue. No credit card required.

Why do we do this? Because we’d love you to know Kruncher and make your work easier.

Start your free trial and analyze five portfolio companies for free, valid for one month.