Whether you're a first-time fund manager, an angel investor scaling up, or a seasoned GP refining your approach, mastering portfolio construction requires balancing competing priorities: risk versus reward, diversification versus concentration, and current opportunities versus future reserves.

This guide breaks down the essential principles and practical frameworks that separate successful portfolios from collections of random bets.

Understanding Portfolio Construction Fundamentals

At its core, portfolio construction is how venture funds systematically deploy capital to maximize risk-adjusted returns. It's the strategic framework that determines which companies you back, how much you invest, and when you double down or walk away.

Unlike public market investing, VC portfolio construction must account for illiquidity, information asymmetry, and the binary nature of startup outcomes. It’s a different game from choosing stocks. You're making multi-year commitments with limited exit options.

The Mandate Every Portfolio Has

Successful portfolio construction serves three fundamental goals, with the last point rarely addressed:

- Maximize Returns

- Minimize Risk

- Don’t forget future rounds: Don’t spend all your cash upfront. Have reserves (dry powder) so you can participate in the future rounds of your winners.

Now, let’s talk about how the skeletons that make up your portfolio construction strategy.

Diversification vs. Concentration

One of the most critical strategic choices in portfolio construction is how broadly to spread your investments.

The Case for Diversification

The same strategy in stock trading. Broad diversification works particularly well for larger funds with substantial capital bases. Big funds like Andreessen Horowitz deploy this strategy, investing across multiple sectors, stages, and geographies to maximize their probability of capturing breakout companies.

Geographic and sector diversification also provides protection against macro risks: economic downturns, regulatory changes, or technological shifts that might impact entire industries or regions.

The Case for Concentration

Concentrated portfolios reflect high-conviction investing based on deep domain expertise. This approach works best when GPs have specialized knowledge that gives them systematic advantages in specific markets.

If you’re a doctor turned angel investor, then you are best positioned to invest in healthcare startups. Domain knowledge is usually the key differentiator between smart bets and flops.

The concentrated also allows funds to provide more support per investment and achieve higher ownership percentages in successful companies.

Smaller funds often favor concentration by necessity. Limited capital requires making bigger bets on fewer opportunities to achieve meaningful ownership levels.

Most successful funds adopt a hybrid strategy: broad diversification within their core competency areas, combined with concentrated bets on their highest-conviction opportunities.

Risk Management Through Strategic Mix

Let’s understand and manage multiple types of risk simultaneously.

Risk based on Risk Profile

For VCs, there’s only 3 types of startups: the loss, the 3x return, and the 50x return.

-

The losses - The product can’t be built, the GTM fails, the founders got into a really bad scandal... Breaking even in this category lucky.

-

The 3x return - with massive addressable markets and the potential for venture-scale returns, though with higher execution risk.

-

The 50x return (moonshots) - Category-defining outcomes but significant technology or market risks.

It’s a given to minimize the losses. In a bucket you pre-determine to be “potential 3x startups”, 50 are 3x returns, the other 50 are losses.

In the moonshot bucket, 1 will deliver 50x returns, 19 will deliver 3x returns, and 80 will be losses.

So, choose which kinds of startups/founders to invest in based on your risk appetite.

Risk based on Stage

Early-stage investments (seed through Series A) offer higher potential returns but with correspondingly higher failure rates. Later-stage investments provide more predictability but require larger capital commitments and offer lower multiples.

You can invest $1M in 100 seed startups and one will grow to a $500M company, 9 will be $30M, and 90 in the loss/break-even category.

Or, invest $25M in 10 Series-A’s and 1 will grow to a $500M company, 4 will be a $100M company, the other 5 losses.

These general percentages come from seed stages being inherently more riskier: unproven product, unproven GTM, and unproven founders.

Factors that affect risk: Market Timing

Avoid over-indexing on current market trends or consensus opportunities. The best investment opportunities often emerge from contrarian positions or sustainable long-term themes rather than current market enthusiasm.

Build scenario plans for different market conditions, like recession, sector downturns, capital market disruptions, and stress-test portfolio construction assumptions against these scenarios.

Capital Allocation and Reserve Management

Securing pro-rata rights in initial investments provides the option to maintain ownership percentages in future rounds. This optionality becomes extremely valuable for successful companies, allowing you to increase your position in proven winners.

Reserve allocation should be milestone-driven/in tranches rather than all upfront. The best-performing funds concentrate follow-on capital on companies hitting specific growth, product, or market indicators rather than distributing reserves equally across all portfolio companies.

Strategic Reserve Management

Adjust based on performance. Companies showing strong traction deserve additional capital, while underperformers should receive minimal follow-on investment unless they demonstrate clear turnaround potential.

A typical $100M fund might deploy $45M in initial investments across 25-30 companies, reserving $40M for follow-ons and $15M for operational expenses. This structure provides flexibility while ensuring adequate dry powder in the future to double-down on portfolio winners.

Practical Framework for Fund Managers

Here are the four steps for fund managers to begin their portfolio construction.

-

Investment Thesis Development: Define target industries, company stages, and geographic focus based on your team's expertise and market opportunities.

-

Capital Allocation Planning: Determine initial investment sizes, reserve multiples, and ownership targets aligned with your fund size and return objectives.

-

Deal Sourcing Infrastructure: Build systematic pipelines through founder networks, other investors, accelerators, and industry connections to find startups.

-

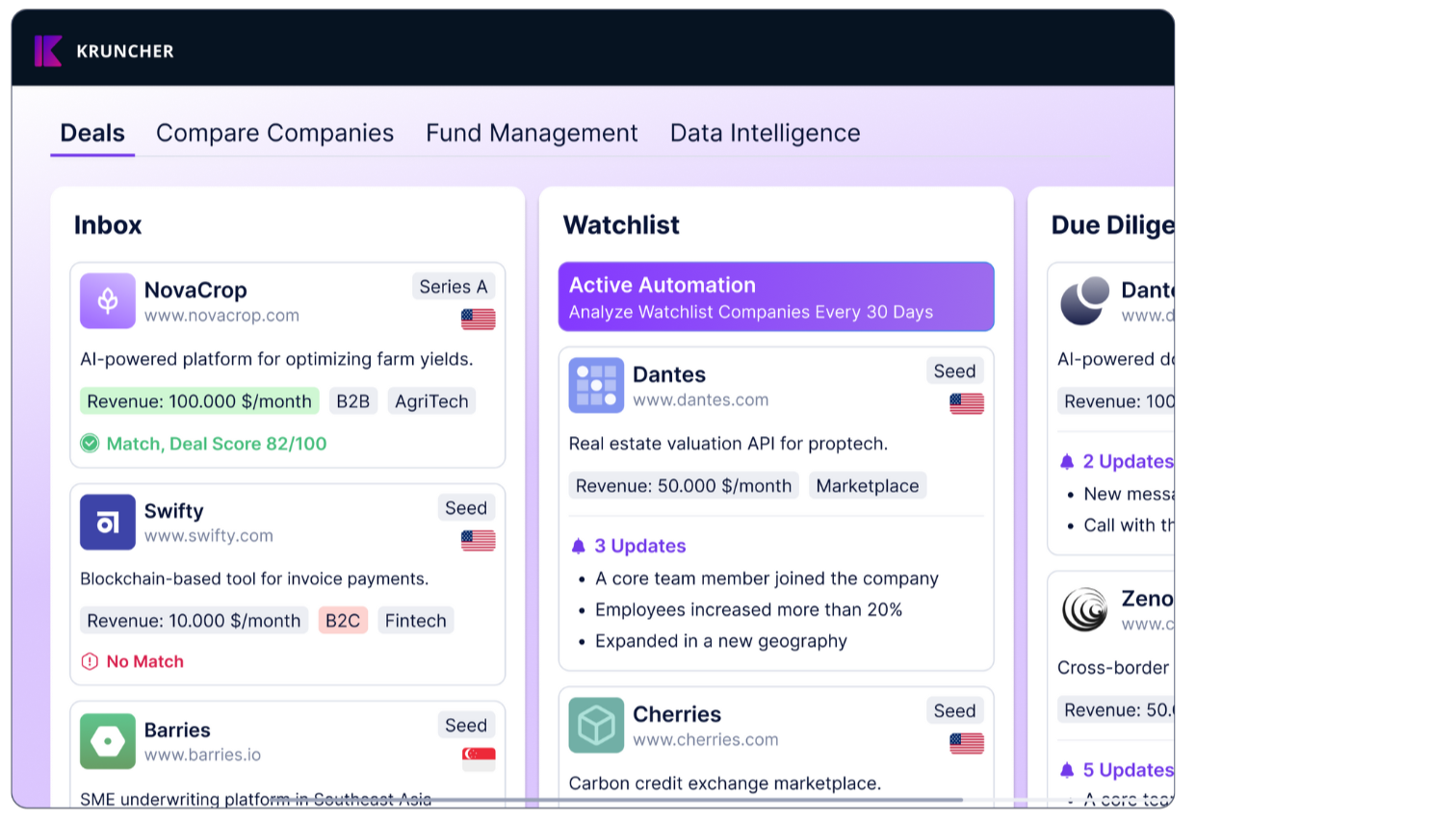

Portfolio Management Systems: Implement tracking and review processes to monitor company progress and guide follow-on investment decisions.

Success comes from balancing multiple competing priorities: diversification with conviction, current opportunities with future flexibility, and risk management with return optimization. Master these balances, and you'll build portfolios that not only survive market cycles but consistently generate superior returns for your investors.

Are you a VC looking to work smarter, not harder? Kruncher is an AI Analyst made specifically for venture capital and private equity. Our free trial stays free forever, no credit card required.