"An analyst would take two months to onboard and a full day to do half of what Kruncher delivers in 15 minutes on day one. It lets us analyze more dimensions and data sources in a single tool, get a complete company report instantly, and make faster, more confident decisions." — Scott Krivokopich, Founding Managing Partner, 1982 Ventures

EXECUTIVE SUMMARY:

Since using Kruncher, 1982 Ventures has seen key improvements in:

- 20x Analysis Capacity: From 20 to 400 companies spotlighted weekly for further prioritization

- Instant Onboarding: New analysts are productive from day one vs. 2-month training

- 30-Minute Reports: Complete company analysis in 30 minutes vs. 2 full days

- Focus on high-value work: Reduced analyst burnout and improved team satisfaction

Who is 1982 Ventures?

1982 Ventures has built a reputation as Southeast Asia's go-to early-stage venture fund, with deep domain expertise in fintech and enterprise technology that allows for faster investment decisions. Southeast Asia represents one of the world's most dynamic fintech markets. With over 650 million people, many underbanked or unbanked, the region offers massive opportunities for financial innovation.

1982 Ventures positioned itself at the center of this transformation, building relationships with founders across payments, lending, insurtech, and digital banking.

Fund Profile:

- Focus: Early-stage fintech and enterprise AI, across Pan-Asia

- Portfolio: ~40 companies with 2 exits

- Deal Flow: 100+ inbound opportunities weekly

- Watchlist: 400+ companies requiring ongoing monitoring

The Challenge

Overwhelming Deal Flow and Watchlist

They are very successful at deal sourcing, but this created a problem: their analysts were overwhelmed with the deal flow, struggling to keep up with the pace in a market where speed to decision can make or break a successful investment.

With 400 companies on their watchlist and only enough analyst capacity to deeply evaluate 20 companies per week, it would take nearly five months just to complete one full cycle of their pipeline analysis. Meanwhile, new deals kept flowing in daily.

Impossible to Scale

Further, early-stage fintech attracts everyone from genuine, brilliant technologists to opportunistic entrepreneurs with no relevant experience. Separating true opportunities from noise, while tracking emerging industry trends at scale became 1982's next milestone focus.

With new analysts requiring two months of training before becoming productive and each analysis taking a full day per company, the fund faced a very daunting scaling challenge.

"We had built an incredible deal flow engine, but we couldn’t properly process them all. We were drowning in opportunities and too much of the firm’s knowledge was silo’d with individual team members.

Our analysts were working overtime and struggling to prioritize opportunities from the deluge of opportunities on their desk.

Kruncher has been a firm multiplier, giving us leverage to spend more time directly with founders prioritizing working on things that move the needle. AI is changing the investment landscape and we want to remain at the forefront."

Working with Kruncher

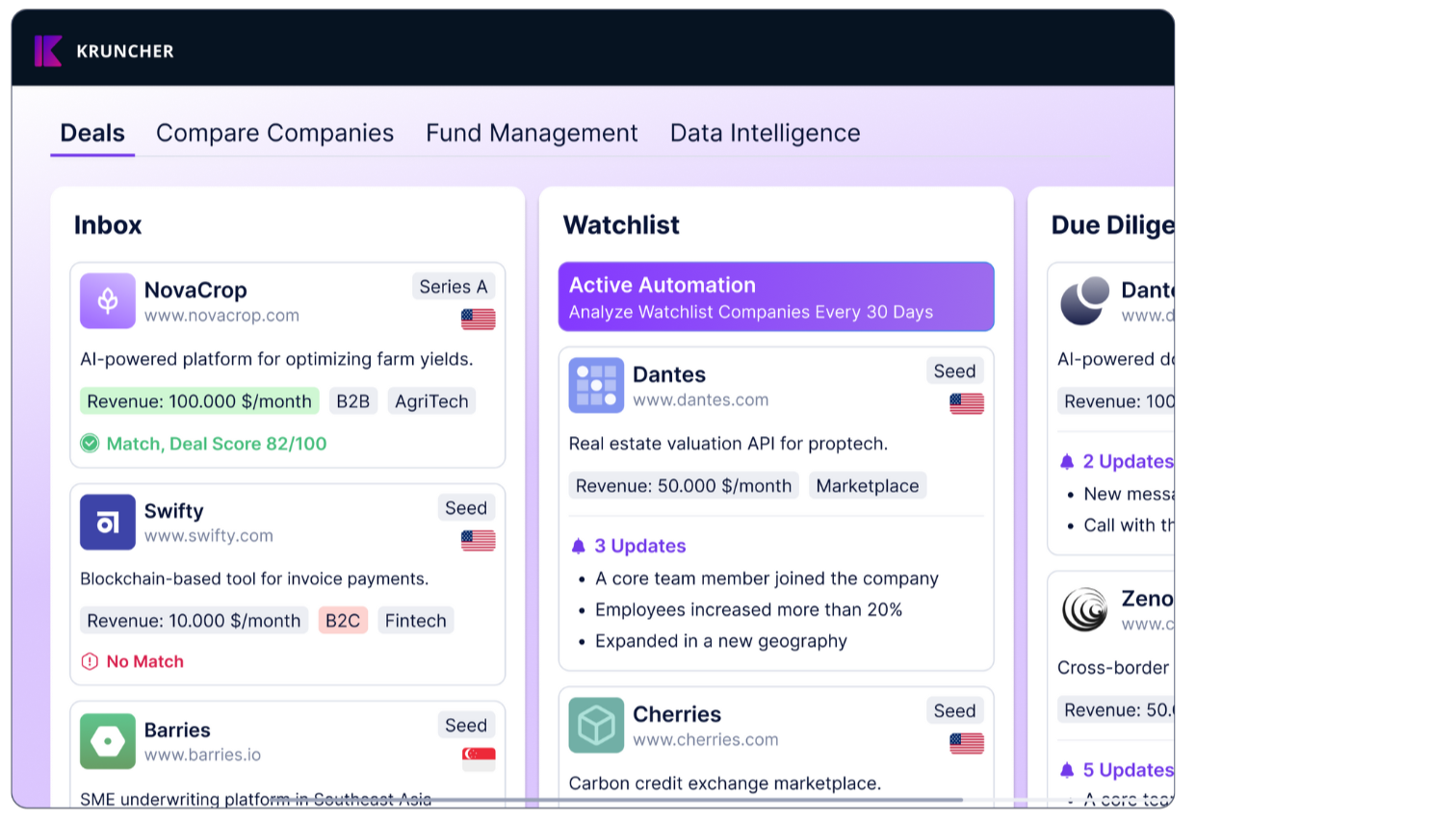

1982 finds Kruncher to be the right partner because every aspect of the tool is data-driven, creating objective insights and recommendations that remove guesswork from investment decisions. Scott particularly values how Kruncher's analysis cuts through founder promises to surface hard metrics and verifiable traction signals.

When onboarding 1982, Kruncher's technical team invested significant time understanding their existing systems and managed the complete integrations with their Attio CRM and Google Drive, ensuring no workflow disruptions.

The weekly check-ins with Kruncher's team ensure 1982's feedback directly influences product development. Scott loves being part of the roadmap discussions, seeing feature requests implemented rapidly.

“It’s great to be working with a team who cares and is transparent. They understand our requirements of data privacy. Integrity is hard to come by.”

How Kruncher Changed 1982 Ventures' Investment Process

1. Instant Analyst Productivity From Day One

The most dramatic change came in analyst onboarding and productivity. Where new hires previously needed two months of training to become effective, Kruncher enables immediate productivity from day one. The platform's comprehensive company reports are tailored to our investment style and thesis, eliminating the learning curve for data gathering and initial analysis.

Now, the fund enables junior team members to contribute meaningfully while senior analysts focus on high-value decision-making.

2. Quality Screening at Scale

Early-stage fintech attracts many founders with limited relevant experience or questionable business models. Kruncher's screening helps identify red flags: founders lacking fintech experience or business models that don't address real market needs.

This filtering ensures 1982's analysts spend their time on legitimate opportunities rather than sifting through noise.

3. Significant Productivity Gains

1982 made a conscious decision to embrace Kruncher's efficiency gains even with slight accuracy trade-offs. Initial reports achieve 85% accuracy versus the 95% accuracy of manual analysis—but they're delivered in 30 minutes instead of a full day.

1982's analysts are no longer just researching, pasting and compiling into our systems and databases.

"We’ve been an early investor to AI tools and workflow automation tools. I know Kruncher isn’t perfect, that’s a fact we need to accept, no tool is. The productivity gain is still worth the accuracy drop, why? Because our analysts and partners can pick up only the relevant ones and get those to 100%, giving us a deeper view of the market and keeping us ahead of our competitors.”

Real Impact: 1982’s Competitive Edge in SEA Fintech

It has become very clear to Scott that using AI to handle volume while preserving human judgment is the future. In the fast-moving Southeast Asian fintech market, this speed advantage is crucial for winning competitive deals.

The fund's ability to maintain comprehensive coverage while moving quickly on promising opportunities gives them a significant edge in a market while still choosing the right deals.

1982 Ventures proves that early-stage funds don't have to choose between thoroughness and speed. By combining AI for speed and human expertise for final decisions, they've created a scalable model for high-volume opportunity assessment.